It seems an appropriate time to study what, if any, have been the macroeconomic consequences of tariffs in practice. Using a straightforward methodology to estimate flexible impulse response functions, and data that span several decades and 151 countries, this column finds that tariff increases have, on average, engendered adverse macroeconomic and distributional consequences: a fall in output and labour productivity, higher unemployment, higher inequality, and negligible effects on the trade balance (likely owing to real exchange rate appreciation when tariffs rise). The aversion of the economics profession to the deadweight loss caused by protectionism seems warranted.

One of the most pressing issues on the international agenda these days is protectionism. The US’ trade war with China has created international tension that is infecting stock markets worldwide, exacerbated by other disputes such as the renegotiation of NAFTA, Brexit, and US steel and aluminium tariffs. One ingredient curiously absent from this turbulence is disagreement among the experts on the merits (or lack thereof) on the underlying issue. Indeed, more than on any other issue, there is agreement amongst economists that international trade should be free.1

Economists have been aware of the senselessness of protectionism since at least Adam Smith. In general, economists believe that freely functioning markets best allocate resources, at least absent some distortion, externality or other market failure; competitive markets tend to maximise output by directing resources to their most productive uses. Of course, there are market imperfections, but tariffs – taxes on imports – are almost never the optimal solution to such problems. Tariffs encourage the deflection of trade to inefficient producers and smuggling to evade the tariffs; such distortions reduce productivity, income and welfare. Further, consumers lose more from a tariff than producers gain, so there is ‘deadweight loss’ as well as inequality (if production tends to be owned by the rich). The redistributions associated with tariffs tend to create vested interests, so harms tend to persist. Broad-based protectionism can also provoke retaliation which adds further costs. All these losses to output are exacerbated if inputs are protected, since this adds to production costs.

Discussions of market imperfections and the like are naturally microeconomic in nature (Grossman and Rogoff 1995). Accordingly, most analysis of trade barriers focuses on individual industries. International commercial policy tends not to be used as a macroeconomic tool, probably because of the availability of superior alternatives such as monetary and fiscal policy. In addition, there are strong theoretical reasons that economists abhor the use of protectionism as a macroeconomic policy; for instance, the broad imposition of tariffs may lead to offsetting changes in exchange rates (Dornbusch, 1974). And while the imposition of a tariff could reduce the flow of imports, it is unlikely to change the trade balance unless it fundamentally alters the balance of saving and investment. The findings of recent studies on the impact of trade would imply that tariffs could hurt output and productivity (Feyrer 2009, Alcala and Ciccone 2004). Further, economists think that protectionist policies helped precipitate the collapse of international trade in the early 1930s, and this trade shrinkage was a plausible seed of WWII. So, while protectionism has not been much used in practice as a macroeconomic policy (especially in advanced countries), most economists also agree that it should not be used as a macroeconomic policy.

The here and now

Times change. Some economies – notably the US – have recently begun to use commercial policy seemingly for macroeconomic objectives. So it seems an appropriate time to study what, if any, the macroeconomic consequences of tariffs have actually been in practice. Most of the predisposition of the economics profession against protectionism is based on evidence that is either a) theoretical, b) micro, or c) aggregate and dated. Accordingly, in our recent research (Furceri et al. 2018), we study empirically the macroeconomic effects of tariffs using recent aggregate data.

In our work, we used a straightforward methodology to estimate flexible ‘impulse response functions’ which allow us to estimate the effects of tariff changes on key macroeconomic variables, holding other factors fixed through an econometric model. We exploit a dataset that spans 1963 up to 2014, and includes 34 advanced and 117 developing countries. We report the responses of six key variables of interest to changes in the tariff rate, including four of the most important manifestations of the health of the real macroeconomy: real GDP, productivity, the unemployment rate, and inequality (the latter measured by the Gini coefficient). We also portray two key transmission mechanisms for tariff shocks, namely, the real exchange rate and the balance of trade.

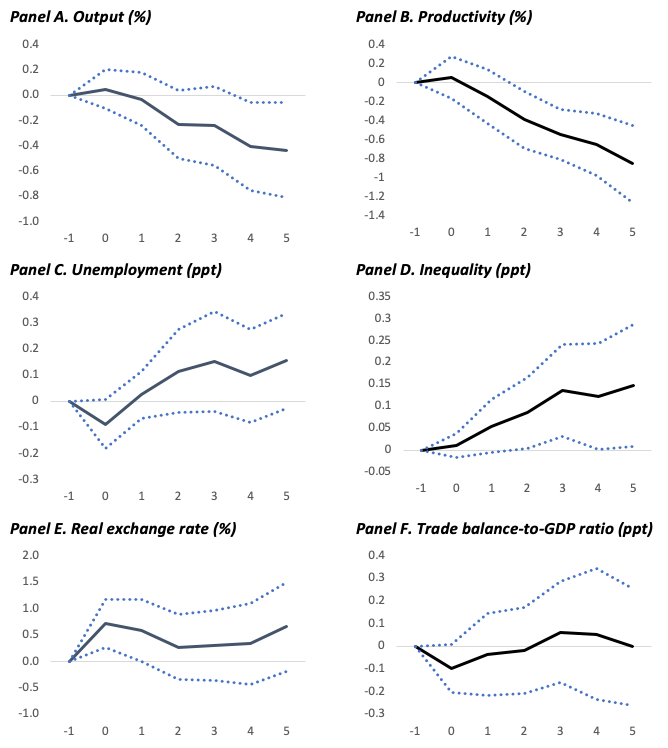

Our results are presented in Figure 1. Each of the six panels presents the estimated response for a variable of interest (output, productivity, and so forth) to a one standard deviation rise in the tariff rate (a moderate increase in the tariff rate of about 3.6 percentage points, which lies well within the standard range of the data). Time is portrayed on the horizontal axes; the solid lines portray the average estimated response, and we include a 90% confidence interval in dots.

Our results are strong – we find that tariff increases have adverse domestic macroeconomic and distributional consequences. Output (shown in Panel A) falls after tariffs rise because of a significant decrease in labour productivity (Panel B). That is, the wasteful effects of protectionism lead to a meaningful reduction in the efficiency with which labour is used, and thus output.

Figure 1 The effect of tariffs

Notes: The solid line indicates the response of output (real exchange rate, trade balance, labour productivity, unemployment, inequality) to a one standard deviation increase in tariff; the dotted lines correspond to 90% confidence bands. The horizontal axis denotes time. t=0 is the year of the change.

Protectionism also leads to a small increase in unemployment, as shown in Panel C. Thus the aggregate results for real activity bolster the traditional case against protectionism. So does the evidence on distribution shown in Panel D – we find that tariff increases lead to more inequality, as measured by the Gini index; the effect becomes statistically significant two years after the tariff change.

The bottom part of Figure 1 portrays key parts of the transmission mechanism between tariffs and the macroeconomy. As expected, higher tariffs lead to an appreciation of the real exchange rate (Panel E), though the effect is only statistically significantly different from zero in the short term (this is unsurprising, given the noisiness of exchange rates). Panel F shows the net effects of higher tariffs on the trade balance are small and insignificant; absent shifts in saving or investment, commercial policy has little effect on the trade balance.

Conventional wisdom redux

To summarise our recent work, the aversion of the economics profession to the deadweight losses caused by protectionism seems warranted. While the case against protectionism has typically been bolstered by theoretical or microeconomic evidence, the macroeconomic case for liberal trade is also strong. Higher tariffs seem to lower output and productivity, while raising unemployment and inequality and leaving the trade balance unaffected. The longer-term consequences of tariffs are likely higher than the medium-term effects that we estimate, but we truncate our analysis at the five-year horizon to be conservative. Further, the considerable sensitivity analysis in our paper demonstrates the robustness of our results.

Our results are wholly consistent with conventional wisdom in the discipline, and bolster the case for free trade. Protectionism just weakens the macroeconomy.

Authors’ note: Relevant materials (output, data, documents) are available at http://faculty.haas.berkeley.edu/arose. The views expressed in this paper are those of the authors and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

References

Alcala, F and A Ciccone (2004), “Trade and Productivity,” The Quarterly Journal of Economics119(2): 613-646.

Dornbusch, R (1974), “Tariffs and Nontraded Goods,” Journal of International Economics 4(2): 177-85.

Feyrer, J (2009), “Distance, Trade, and Income – The 1967 to 1975 Closing of the Suez Canal as a Natural Experiment,” NBER Working Paper No. 15557.

Grossman, G M and K Rogoff (1995), Handbook of International Economics, Volume III, Elsevier Science Publishers.

Furceri, D, S A Hannan, J D Ostry and A K Rose (2018), “Macroeconomic Consequences of Tariffs,” CEPR Discussion Paper 13389.

Endnotes

[1] For example, see the survey on free trade in Initiative on Global Markets (University of Chicago Booth School of Business) at http://www.igmchicago.org/surveys/free-trade

[To read the original paper, click here.]

Copyright © 2019 VoxEU. All rights reserved.