Article originally published on voxeu.org

Recent studies documenting the increase of industrial concentration have raised concerns about an era of monopolies, growing profit shares, and low economic dynamism. Using US data, this column investigates the concentration of import sales by country of origin. The results show that among foreign firms selling to the US, the concentration of sales has remained stable by origin country, but it has fallen when pooling firms from all origins. This suggests that intensified competition in international markets coexists with growing concentration among national producers.

We live in a superstar economy in which top firms command a disproportionate share of sales and wealth. According to The Economist (17 September 2016), 10% of the world’s public companies generate 80% of all profits, and the share of GDP generated by the Fortune 100 biggest US companies rose from about 33% of GDP in 1994 to 46% in 2013. A large number of papers have documented that, since the late 1990s, the fraction of sales accrued by top firms and other concentration indexes have risen in most US sectors (e.g., see Autor et al. 2017, Rossi-Hansberg et al. 2018). International evidence, albeit more sparse, indicates that concentration has grown in several OECD countries too. Large firms also dominate exports. In a sample of 32 mostly developing countries, the top five firms account on average for 30% of a county’s total exports (Freund and Pierola 2015). These observations have raised serious concerns that the growth of superstar firms may be synonymous with lower competition (Eeckhout and De Loecker 2017). The size of the phenomenon is so large that it has attracted the attention of media and policymakers.

The existing evidence points at growing concentration among national firms. However, companies from different countries compete in markets that are increasingly global. Surprisingly, concentration in international markets has received nearly no attention (the only attempt being Freund and Sidhu 2017). In a recent paper (Bonfiglioli et al. 2019), we use a unique transaction-level data set to study changes in the concentration of US imports between 2002 and 2012. Focusing on imports allows us to complement the picture arising from national production data, by enabling us to document how firms from multiple countries compete in the world’s largest global market.

National versus international trends in concentration

Our analysis draws on the universe of waterborne imports to the US in the years 2002 and 2012 from the Piers database (IHS Markit), which contains information including the full name of the exporting firm, its country of origin, the exported product (according to the 6-digit level of the HS classification), and the value and quantity of each transaction. The final sample used in the analysis comprises 1,311,835 observations at the firm-product-year level, covering 366 manufacturing industries and 104 origin countries.

We measure industry concentration using both the share of total sales that is accrued by the four largest firms in an industry and the industry’s Herfindahl-Hirschman Index. We compute these measures both by industry – that is, pooling firms’ sales from all origin countries – and by industry and country of origin. For comparison, we also compute the corresponding concentration measures among US firms from COMPUSTAT. Table 1 shows that, in the average industry, the top-four firms account for 79% of all imports by the average country (Panel A) and 37% of imports from all countries (Panel B). Interestingly, concentration among US firms is comparable to the level observed by country (Panel C). The table also reports changes in the concentration indexes between 2002 and 2012. Over the decade, concentration among firms from the same country barely changed. However, concentration among firms from all countries decreased significantly – the share of sales by the top-four firms fell by 8 percentage points. Conversely, as is well known, the top-four share among US firms increased by 5 percentage points.

Table 1 Descriptive statistics on concentration measures

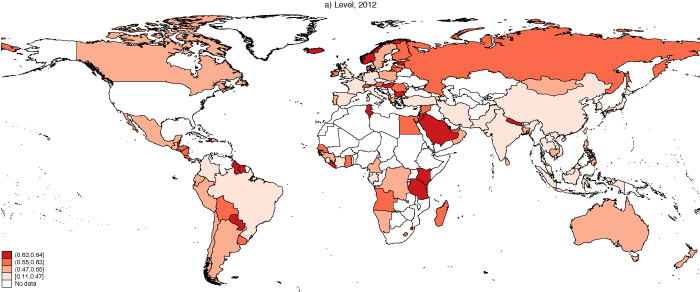

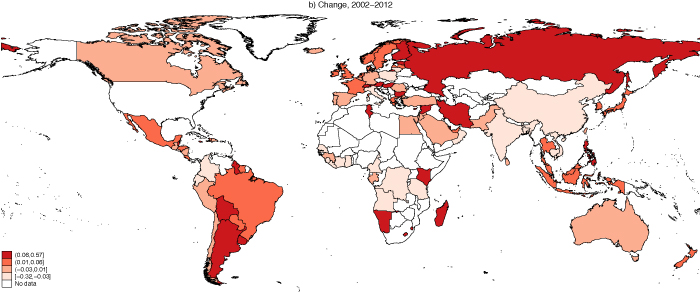

Figure 1 shows some interesting geographical patterns in the levels and changes in concentration across countries. From the top map of Figure 1, in 2012, concentration appears to be lower than average in Western Europe, India, China, and some parts of Southeast Asia. It is higher in parts of Eastern Europe, the Middle East, and Russia. The bottom map shows that, between 2002 and 2012, concentration grew in Latin America, Eastern Europe, and Russia, and has fallen in China and India.

Figure 1 Levels and changes in the Herfindahl Index of concentration across countries

Decomposing trends in concentration

Having documented the main trends in the data, we derive a simple decomposition that allows us to quantify the contribution of various firm-level characteristics to the observed changes in concentration, as measured by top firms’ shares. Building on Bonfiglioli et al. (2018b) and Redding and Weinstein (2018b), the characteristics that we can identify are:

- the number of firms;

- the number of products per firm;

- average sales per product; and,

- heterogeneity across firm-products.

We perform our decompositions both at the industry and at the industry-origin country level.

Focusing on the change in the share of sales by the top-four firms, we find that by far the most important factor in explaining the fall in concentration in the US import market is the extensive margin. First, there is a large increase in the number of firms that start exporting to the US, by 27% on average at the country-industry level and by 75% when pooling firms from all origin countries. Second, the extensive margin plays an important role also within firms. While all firms are shedding products, top firms are dropping proportionally more products than other firms, with a difference of 15% versus 7% at the country-industry level and of 43% versus 10% at the industry level.

Other things being equal, the increase in the number of firms and the decrease in the relative number of products by the top firms would have commanded a pervasive fall in industry concentration. Yet the intensive margin has worked in the opposite direction. The average sales per product of the top firms has grown significantly relative to the other firms, by 31% at the country-industry level and by 78% at the industry level, thereby pushing towards rising concentration. Interestingly, all effects are stronger when focusing on concentration from all origin countries – entry is stronger, but so is divergence of top firm-products. However, when considering firms from a single origin country, the opposite effects of the intensive and extensive margins almost exactly cancel out.

As a further step, we decompose the change in the intensive margin – that is, average sales per product of the top firms – to quantify the contribution of the average relative appeal of top firms’ products and of the dispersion in appeal across top firms. Although changes in the average appeal of top firm-products account for more than three quarters of the change in the intensive margin, a sizeable fraction is accounted for by differential growth within top-firm products. These findings imply that firms do not grow uniformly and that the growth of top products contributed significantly to raising industry concentration.

Conclusions

Much ink has been spilled on the recent increase in industrial concentration, raising concerns that the advent of giant companies may usher in an era of monopolies. However, all existing evidence has been based on national data. Our findings challenge the view that markets are becoming less competitive. Concentration of US imports by country of origin has remained stable while it has fallen significantly when pooling firms from all origins. The sheer increase in the number of firm-products exported to the US suggests that the overall level of competition may have intensified rather than fallen, even if the number of US entering firms has declined.

These results suggest a more benign view, according to which national concentration and international competition coexist and may be two sides of the same coin – growing global competition may force unproductive firms to exit and top-firms to consolidate on their best products (Mayer et al. 2014). However, they also show that firms are growing more and more unequal, a finding confirmed in various studies (Bonfiglioli et al. 2018a, 2019, Dunne et al. 2004, Faggio et al. 2010). Better understanding the causes and consequences of this process is therefore an important avenue for future research.

References

Autor, D, D Dorn, L F Katz, C Patterson and J Van Reenen (2017), “The fall of the labor share and the rise of superstar firms,” NBER Working paper no 23396.

Bonfiglioli, A, R Crinò and G Gancia (2018a), “Betting on exports: Trade and endogenous heterogeneity,” Economic Journal 128: 612–651.

Bonfiglioli, A, R Crinò and G Gancia (2018b), “Firms and economic performance: A view from trade,” CEPR Discussion paper 12829.

Bonfiglioli, A, R Crinò and G Gancia (2019), “Concentration in international markets: Evidence from US imports,” CEPR Discussion paper 13566.

De Loecker, J and J Eeckhout (2017), “The rise of market power and the macroeconomic implications,” NBER Working paper no 23687.

Dunne, T, L Foster, J Haltiwanger and K Troske (2004), “Wage and productivity dispersion in US manufacturing: The role of computer investments,” Journal of Labor Economics 22: 397–429.

Faggio, G, K Salvanes and J Van Reenen (2010), “The evolution of inequality in productivity and wages: Panel data evidence,” Industrial and Corporate Change 19: 1919–1951.

Freund, C and M D Pierola (2015), “Export superstars,” Review of Economics and Statistics 97: 1023–1032.

Freund, C and D Sidhu (2017), “Global competition and the rise of China,” PIIE, Working Paper 17-3.

Mayer, T, M Melitz and G Ottaviano (2014), “Market size, competition, and the product mix of exporters,” American Economic Review 104(2): 495–536.

Redding, S and D Weinstein (2018b), “Accounting for trade patterns,” Mimeo, Columbia University.

Rossi-Hansberg, E, P-D Sarte and N Trachter (2018), “Diverging trends in national and local concentration,” CEPR, Discussion paper 13174.

Copyright © 2019 Vox EU CEPR Policy Portal. All rights reserved.

[To read original article, click here]