Overview

Some Members of Congress, the Trump Administration, and some U.S. businesses have raised concerns over the risks to continued U.S. technological leadership to support national defense and economic security due to growing foreign direct investment (FDI), primarily by Chinese firms, in U.S. high-tech companies. On August 13, 2018, President Trump signed into law new rules governing foreign investment national security reviews. Known as the Foreign Investment Risk Review Modernization Act (FIRRMA) of 2018 (Title XVII, P.L. 115-232), the legislation amends the current process for the Committee on Foreign Investment in the United States (CFIUS) (under P.L. 110-49) to review, on behalf of the President, the national security implications of FDI in the United States.

CFIUS is an interagency body comprised of nine Cabinet members, two ex officio members, and others as appointed that assists the President in overseeing the national security risks of FDI in the U.S. economy. Since its inception in 1975, CFIUS has confronted shifting concepts of national security and a changing global economic order that is marked by the rise of such emerging economies as China and state-led firms that are playing a more active role in the global economy. The FIRRMA-amended CFIUS process maintains the President’s authority to block or suspend proposed or pending foreign “mergers, acquisitions, or takeovers” of U.S. entities, including through joint ventures, that threaten to impair the national security.

To exercise his authority under CFIUS, the President must (1) conclude that other U.S. laws are inadequate or inappropriate to protect national security; and (2) have “credible evidence” that the foreign interest exercising control might take action that threatens to impair U.S.

national security. In addition, final determinations by the President are not subject to judicial review.

The Foreign Investment Risk Review Modernization Act of 2018

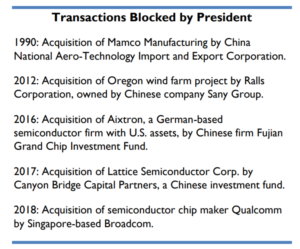

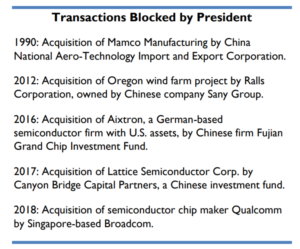

FIRRMA aims to “strengthen and modernize” the current CFIUS process for reviewing potential effects of foreign investment transactions on U.S. national security, last updated in 2007. Certain provisions are immediately to take effect, while others, including some related to the expanded scope of CFIUS, are to be subject to further regulations. Some experts have suggested that the broad changes under FIRRMA could potentially lead CFIUS to take a more assertive role that emphasizes both U.S. economic and national security interests, particularly relative to the development of emerging or leading-edge technology. FIRRMA maintains core components of the current CFIUS three-step process for evaluating proposed or pending investments in U.S. firms, but increases the allowable time for reviews and investigations: (1) a 30-day declaration filing; (2) a 45-day national security review (from 30 days), including an expanded time limit for analysis by the Director of National Intelligence (from 20 to 30 days); (3) a 45-day national security investigation, with an option for a 15 day extension for “extraordinary circumstances;” and a 15-day Presidential determination (unchanged). To date, prior to FIRRMA, Presidents used CFIUS to block five foreign investment transactions.

FIRRMA broadens CFIUS’ role by explicitly including for review certain real estate transactions in close proximity to a military installation or U.S. government facility or property of national security sensitivities; any noncontrolling investment in U.S. businesses involved in critical technology, critical infrastructure, or collecting sensitive data on U.S. citizens; any change in foreign investor rights; transactions in which a foreign government has a direct or indirect substantial interest; and any transaction or arrangement designed to evade CFIUS. Proposed regulations were published September 17, 2019. Without mentioning specific countries, FIRRMA allows CFIUS potentially to discriminate among foreign investors by country of origin and transactions tied to certain countries in reviewing certain investment transactions, pending specific criteria defined by regulations.

FIRRMA also shifts the filing requirement for foreign firms from voluntary to mandatory in certain cases and provides a two-track method for reviewing transactions. Some firms are permitted to file a declaration to CFIUS and could receive an expedited review process, while transactions involving a foreign person in which a foreign government has, directly or indirectly, a substantial interest (to be defined by regulations, but not including stakes of less than 10% voting interest) would require a written notification and receive greater scrutiny. Mandatory declarations may be subject to other criteria as defined by regulations.

FIRRMA provides a “sense of Congress” concerning six additional factors that CFIUS and the President may consider to determine if a proposed transaction threatens to impair U.S. national security. These include

- Transactions that involve a country of “special concern” that has a strategic goal of acquiring critical technology or critical infrastructure that would affect U.S. leadership in areas related to national security;

- The potential effects of the cumulative control of, or pattern of recent transactions involving, any one type of critical infrastructure, energy asset, critical material, or critical technology by a foreign government or person;

- Whether any foreign person engaged in a transaction has a history of complying with U.S. laws and regulations;

- Control of U.S. industries and commercial activity that affect U.S. capability and capacity to meet the requirements of national security, including the availability of human resources, products, technology, materials, and other supplies and services;

- A transaction is likely to expose personally identifiable information, genetic information, or other sensitive data of U.S. citizens to access by a foreign government or person to exploit information to threaten national security; and

- A transaction is likely to exacerbate or create new cybersecurity vulnerabilities or result in a foreign government gaining a significant new capability to engage in malicious cyber-enabled activities.

Other Changes

FIRRMA also mandates other changes that would provide more resources for CFIUS, add new reporting requirements, and reform export controls.

- Resources. Provides for more staff and funding for CFIUS through authorization of a $20 million annual appropriation and a filing fee for firms of 1% of the value of the transaction, not to exceed $300,000.

- Risk-Based Analysis. Formalizes CFIUS’ use of risk-based analysis by assessing the threat, vulnerabilities, and consequences to national security of transactions.

- Reporting. Modifies CFIUS’ annual confidential report to specified Members of Congress and nonconfidential reports to the public to provide for more information on investment transactions, including specifically those involving China.

- Export Controls. Mandates separate reforms related to dual-use export controls, with requirements to establish an interagency process to identify so-called “emerging and foundational technologies”—such items would also fall under CFIUS review of critical technologies—and establish controls by the Department of Commerce on the export or transfer of such technologies.

Response by Other Countries

FIRRMA also recommends that CFIUS establish a process for exchanging information with U.S. allies and partners to facilitate coordinated action with respect to trends in FDI and technology that pose national security risks. The United States is not alone in adopting new regulations governing the review of foreign investment for national security implications. Recent actions by other countries include

- In February 2019, the European Commission approved a block-wide mechanism for screening FDI to build on national review mechanisms already in place in 12 member states.

- In May 2018, Canada blocked the Chinese acquisition of a Canadian construction company.

- In July 2018, the British government issued a draft paper proposing additional authority to review acquisitions and to “call in” previously-concluded investments for national security reviews.

- In July 2018, Germany blocked the Chinese takeover of a German machine tool manufacturer and expanded its authority to block acquisitions of firms involved in “critical infrastructure.”

- In July 2018, China proposed new draft regulations to expand the foreign investments covered under its national security review process.

Issues for Congress

- The FIRRMA-amended CFIUS process for reviewing certain foreign investment transactions may raise a number of questions for Congress, including

- How will Congress evaluate the success of the amended review process in protecting U.S. national security?

- Does the expanded CFIUS review process balance the traditionally open U.S. investment climate with the requirement to protect U.S. national security?

- How does CFIUS compare to other countries’ review processes, and to what extent will FIRRMA facilitate greater information sharing to advance national security?

For more information, see CRS In Focus IF10177, The Committee on Foreign Investment in the United States, by James K. Jackson

CRS CFIUSTo read original report, click here