Supplying inputs to multinational firms has been shown to increase the productivity of domestic firms, while borders have been shown to substantially reduce trade activities. This column investigates whether spillover effects from multinationals on local firms occur when firms are separated by a national border. Using data for seven Central and Eastern European countries and their neighbours, it finds that cross-border spillovers only occur after EU integration, and that participation in the Schengen Area magnifies these effects. The results bear testimony to successful EU integration and warn about potential productivity costs to local firms should border controls be reinstated.

Foreign direct investment (FDI) has increased substantially over the past decades, prompting many researchers to investigate the effects of multinational activity on local firms’ productivity. Whilst evidence remained mixed for a long time, one important consensus in recent literature relates to the positive impact that foreign affiliates have on their local suppliers’ productivity – the backward spillover (Javrocik 2004, Havránek and Irŝová 2011). Notwithstanding increases in trade, economic integration, and the establishment of global value chains, most of the literature (implicitly) assumes that spillovers are bound by country borders. This is doubtful in the case of economic unions comprising of a single market and where border controls are minimal or non-existent. After all, one should expect successful integration to minimise the impact of borders.

The European integration project has been one of the most far-reaching and successful integration projects around the world, but it has been going through hard times recently. Border restrictions have once more been put firmly on the agenda by the refugee crisis and Brexit. The latter not only prompted a discussion on the Irish border, but also on expected customs delays that might lead to lorry congestion at the seaport of Dover.

In a recent paper, we analyse how border restrictions affect the existence and magnitude of cross-border productivity spillovers (Merlevede and Purice 2019). For this purpose, we look at manufacturing firms in seven Central and Eastern European countries (CEECs) as well as their neighbours. The CEECs only opened up to FDI after the collapse of communism in the early 1990s and they have evolved from outsiders to fully fledged EU members, implying substantial changes in border regimes. Because the CEECs have integrated with the EU at a different pace and to a different extent, we are able to set up a difference-in-difference analysis to test the impact of border regimes on cross-border knowledge spillovers.

Why (EU) borders matter for knowledge spillovers through the supply chain

Key to the backward spillover is that multinationals have an interest in sharing their advanced knowledge with their local suppliers to help the latter become more efficient and deliver better products. Because backward spillovers involve the exchange of goods or services, barriers to trade that increase the cost of cross-border supply chains over national ones will affect cross-border spillovers. Research on borders and their impact on trade have been conducted ever since McCallum (1995), with most analyses pointing to a substantial reduction in trade activities in the presence of borders. While this can be partly explained by trade barriers such as tariffs and quotas between countries, non-tariff-barriers are important as well. For instance, recent studies by Hornok and Koren (2015) and Volpe Martincus et al. (2015) suggest that administrative barriers, such as regulatory requirements and time spent in customs, can significantly reduce trade. Handley and Limão (2017) further find a role for policy uncertainty in explaining trade flows. Clearly, the CEECs’ EU accession will have alleviated many of these issues, thereby increasing the potential for cross-border spillovers in the region.

On top of EU accession, participation in the Schengen Area further reduces potentially long and unpredictable waiting times for border officers to complete security checks and grant border passage. This matters for backward spillovers because the absence of key components due to late arrival can idle entire plants. The ability to ship rapidly and predictably is therefore of high value (Hummels and Schaur 2013). The movement of people will also matter. Because multinational enterprises have an interest in technological upgrading by their suppliers, they have an incentive to provide them with explicit assistance. Giroud (2013) shows that headquarters’ proximity to plants increases plant-level investment and productivity. Proximity facilitates human interaction, communication, and monitoring, all necessary components of successful assistance and upgrading. Schengen participation facilitates such interaction.

Research design

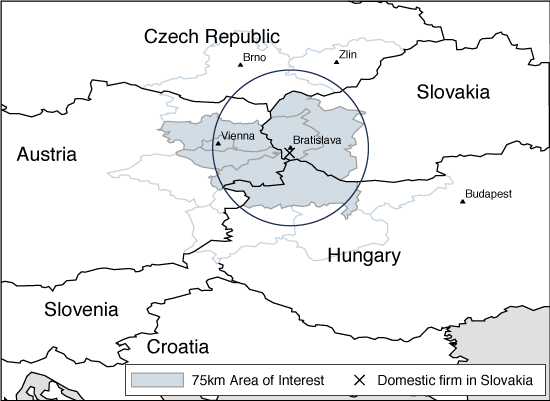

We analyse spillovers as a firm-specific productivity effect of increased foreign presence, distinguishing between foreign presence in a firm’s own industry (horizontal) as well as in client industries (backward). For our analysis, we define a distance-specific area of interest around a domestic company located close to the border, such that a part of foreign activity will be located in the same country as the domestic firm and another part across the border. This allows us to separate the effects of these two sources of potential spillovers. Since we do not know the exact location of each firm, but we do know the NUTS1 3-digit region where a firm is active, we use regions’ administrative centres for determining which regions will belong to the firm’s area of interest. Figure 1 displays this strategy for a Slovak firm located near Bratislava, with potential spillovers from foreign activity at home in Slovakia, as well as over the border in Austria or Hungary.

Figure 1 The area of interest for a domestic firm located near Bratislava

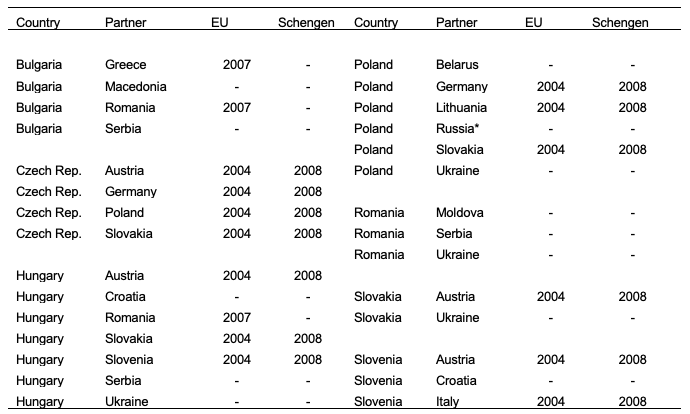

We use rich firm-level data from Merlevede et. al (2015) for firms active in the countries listed in Table 1. We collect information for firms in regions that are prone to cross-border spillovers, using a baseline distance of 75km. We then identify the impact of border regimes on the existence and size of cross-border spillovers, exploiting variation in the timing and extent of European integration of the seven CEECs and their neighbours during the period 2000-2010. Table 1 lists the borders we consider in our analysis, as well as if and when they are affected by two ‘treatments’: EU accession and Schengen participation.

Table 1 Border regimes in the sample

Notes: * Kaliningrad. EU indicates whether and when a border becomes an internal EU border; Schengen indicates a border between members of the Schengen Area. All Schengen borders in our sample enter into force on 21 December 2007. This holds for overland borders and seaports; for airports, the exact date is 30 March 2008. Because our data are annual, we consider 2008 as the first year these borders are classified as ‘Schengen borders’. As we do not have data for Turkish firms, we do not consider the Bulgaria-Turkey border.

Impact of border regimes on spillovers

Our findings consistently show that backward spillovers only arise when borders are not ‘thick’. More specifically, we find that supplying inputs to a multinational just across the border is productivity-enhancing only if the countries are separated by an EU border. These spillovers become even stronger when borders become seamless, as is the case in the Schengen Area. Point estimates imply that an increase of one standard deviation in FDI activity results in a productivity level that is 3.7%, 2.0%, and 5.9% higher for within-country, cross-border EU, and cross-border Schengen effects, respectively. Both the cross-border EU and the cross-border Schengen effect cannot be rejected to equal the within-country effect, but they do differ from the insignificant cross-border non-EU effect. They are also statistically different from one another. These results are not dependent on the choice of distance and pass a series of additional robustness checks.

Summary and policy implications

These results suggest that EU integration has been imperative for the emergence of cross-border FDI spillovers through the supply chain, as no productivity effects can be detected prior to the CEE countries’ EU accession or for borders with non-EU member states. Moreover, the largest productivity impact is achieved under full integration with seamless borders, via the removal of border security checks in the Schengen Area. The results confirm the success of the single market from the perspective of knowledge transfer through European cross-border value chains.

Our findings also warn against policies that might reverse integration by re-instating border restrictions, as seen with regards to Brexit or the recent refugee crisis. Governments should also take the potential productivity costs to domestic firms into account when considering more restrictive border policies, as these will weaken cross-border cooperation between multinationals and their suppliers, leading to less knowledge spillovers.

References

Giroud, X (2013), “Proximity and investment: Evidence from plant-level data”, The Quarterly Journal of Economics 128(2): 861-915.

Handley, K, and N Limão (2017), “Policy uncertainty, trade, and welfare: Theory and evidence for China and the United States”, American Economic Review 107(9): 2731-83.

Havránek, T, and Z Irŝová (2011), “Estimating vertical spillovers from FDI: Why results vary and what the true effect is”, Journal of International Economics 85(2): 234-44.

Hornok, C, and M Koren (2015), “Administrative barriers to trade”, Journal of International Economics 96: S110–S122.

Hummels, D, and G Schaur (2013), “Time as a trade barrier”, American Economic Review 103(7): 2935-59.

Javorcik, B (2004), “Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages”, American Economic Review 94(3): 605-27.

McCallum, J (1995), “National borders matter: Canada-U.S. regional trade patterns”, American Economic Review 85(3): 615-23.

Merlevede, B, M de Zwaan, K Lenaerts and V Purice (2015), “Multinational networks, domestic, and foreign firms in Europe”, Working Paper 900, Department of Economics, Ghent University, Belgium.

Merlevede, B, and V Purice (2019), “Border regimes and indirect productivity effects from foreign direct investment”, Working Paper 965, Department of Economics, Ghent University, Belgium.

Volpe Martincus, C, J Carballo and A Graziano (2015), “Customs”, Journal of International Economics 96(1): 119-137.

Endnotes

[1] Nomenclature of Territorial Units for Statistics.

[To read the original paper, click here.]

Copyright © 2019 VoxEU. All rights reserved.