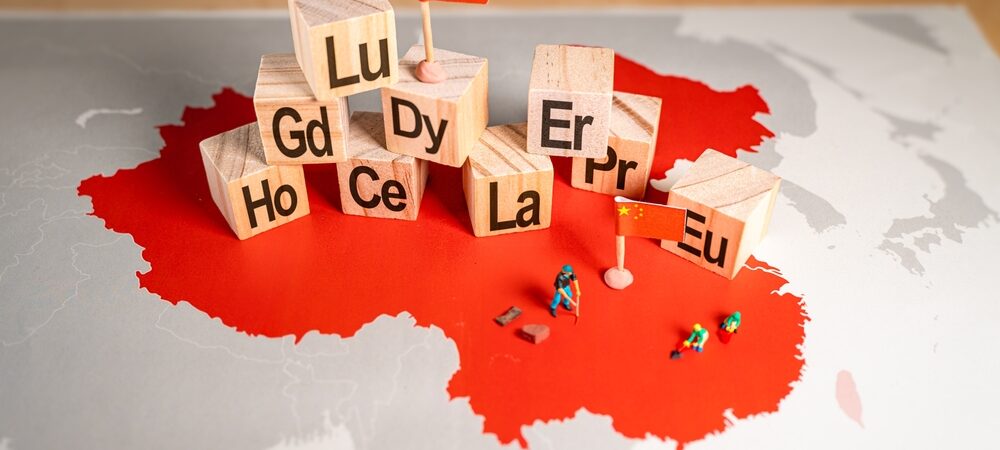

Great power competition between the United States and China centres on technological supremacy. This extends beyond future-defining technologies such as high-end chip manufacturing, advanced AI, and quantum computing to include the supply chains underpinning these technologies, particularly critical minerals.

As the clean energy transition accelerates, critical minerals such as cobalt, lithium, and rare earth elements have become buzzwords in business, international relations, and sustainability.

Yet amid the scramble for these well-known resources, another metal – antimony – has quietly emerged as another keenly contested resource. With China’s recent announcement of export restrictions on this metal, the challenges of balancing supply and demand are intensifying, raising concerns over supply chain vulnerabilities and fuelling a new form of competition among great powers.

Antimony, a lustrous silvery-grey metalloid, is scarce in nature and unevenly distributed globally. It is, however, critical for producing high-tech and defence products, including flame-retardant materials, certain semiconductors, and superhard materials. As with many critical minerals, China dominates the global antimony supply chain. The country holds the world’s largest deposit, accounting for approximately 32% of global antimony resources, yet it produces more than 48% of global output.

China’s move to restrict the export of antimony, ostensibly to safeguard “national security and interests”, is set to take effect on 15 September. While these restrictions are not explicitly targeted at any specific country, the geopolitical implications are significant. China has gradually reduced its antimony production over the past few years to limit strategic stockpiling. As a result, the announcement has driven up prices, potentially disrupting global supply chains. The impact is particularly acute for the United States, which sourced 63% of its antimony imports from China.

China’s export control of this critical metal might appear a calculated move within the broader framework of resource nationalism. Beyond safeguarding strategic resources and preventing over-exploitation, these controls reinforce China’s leadership in the global antimony industry, enhancing its influence over the international allocation of this critical mineral. This move, thus, is not just about acquiring and protecting resources; it is also about denying rivals a strategic advantage.

Antimony is one of the few elements classified as a “critical” or “strategic” mineral by countries including the United States, China, Australia, and Russia, as well as the European Union, underscoring its special geopolitical value. Following similar restrictions on germanium, gallium, graphite, and rare earths, China’s export control of antimony marks another move to leverage its dominance in global supply chains. This action serves as a response to US efforts to limit the availability to China of critical technologies such as high-end chips .

China’s anitimony announcement has not gone unnoticed by markets. In Australia, the response has been notably positive. Larvotto Resources, a leading exploration and pre-development company focused on high-demand commodities including antimony, saw its share price surge as it possesses the rights to operate the Hillgrove Gold-Antimony Project, the eighth-largest in the world. The assumption is that Australia will fill the market gap left by China. In an effort to counter China’s dominance in critical mineral supply chains, the United States had forged partnerships with resource-rich countries including Australia.

However, China’s export restrictions target antimony oxides with a purity of 99.99% or higher, as well as other high-purity antimony compounds (99.999%). Producing such high-purity chemical compounds requires advanced processing technologies, and export controls with this high-purity threshold are likely aimed at restricting the export of high value-added antimony products and advanced processing technologies. These ultra-pure products are used in specialised industries, including high-end electronics, optics, and defence applications.

Australia’s ability to mitigate the risks associated with China’s dominance remains limited. China is a net importer of antimony metal. Currently, 86% of Australia’s antimony exports are sent to China for processing. Investing in processing capacity and infrastructure for lower-grade antimony products may offer limited strategic value for the United States, as these products will still be available under China’s restrictions. Conversely, developing high value-added processing technologies to produce high-purity antimony products carries significant risks, particularly if China decides to retaliate in trade or lift these restrictions. In the latter case, even if alternative processing technologies become available in Australia, the market – including the United States – may still turn to China for more cost-efficient products, potentially rendering Australia’s investments obsolete.

Navigating these dynamic complexities and maintaining an independent policy in the face of great power competition will be a true test of political acumen for Australian policymakers.

The competition over antimony is merely the latest manifestation in the great power rivalry that centres on technological supremacy. Each side is manoeuvring to secure critical materials and technologies, define future systems, and outpace the other in innovation.

The underlying issue is a deepening lack of trust between these global powers. This mistrust fuels the tug-of-war over resources, with nations viewing control over materials as crucial for maintaining technological dominance.

However, this relentless pursuit of supremacy comes with significant downsides: fragmented global supply chains, rising resource nationalism, and intensified trade restrictions. Cooperation gives way to competition, and technological progress risks becoming a zero-sum game.

To read the article as it was published on the The Interpreter webpage, click here.