Trade has been a primary topic of public policy discussion over the past two years. Much of the discussion has focused on determining ways to stop the alleged unfair trade practices by China. Undoubtedly, it is important for the U.S. to hold trading partners accountable for violations of their international obligations, just as other countries keep U.S. trade policy in check. However, the trade dispute that has ensued between the U.S. and China is having repercussions. In principle, disputes over trade, with China or any other country, should be addressed through the dispute-resolution body at the World Trade Organization (WTO). In recent months, the primary strategy of the Trump Administration has not been to file cases against China at the WTO. Instead, President Trump imposed unilateral tariffs on more than $250 billion worth of goods from China. Bilateral negotiations with China are ongoing, but it is unclear if these tariffs will be removed anytime soon.

As the debate over how to address trade disputes with China unfolds, it is important that all participants are equipped with the facts. Unfortunately, the policy discussion is not always driven by data and hard evidence. Trade is beneficial because it exposes individuals in both countries to a greater variety of goods at different prices. So, the Administration’s imposition of tariffs on Chinese goods threatens to diminish these benefits by causing artificially higher prices in the U.S., and could even put American jobs at risk. Indeed, the trade restrictions have already affected at least 44 percent of goods imported from China, and 12 percent of total U.S. imports during 2018 alone.

The purpose of this Special Report is to answer 11 common questions that are driving the debate regarding trade with China. Each question is answered with facts, and in most instances, supporting data. In order to explain this complicated topic in a digestible manner, an appendix is included with the definitions of common economic terms and phrases.

Question #1: Has America Lost Thousands of Jobs to China?

Critics of free trade, especially trade with China, frequently claim that the U.S. has lost millions of jobs because of its openness. This claim is often associated with reports of companies moving parts of production offshore. Critics also cite the growing trade deficit (explained in Question #5). In a 2017 report, the Economic Policy Institute claimed that “due to the trade deficit with China 3.4 million [U.S.] jobs were lost between 2001 and 2015.”

Answer #1: America has not lost net jobs due to trade with China, or with any other country.Employment in the manufacturing sector has decreased by roughly 4.8 million jobs since 1999.

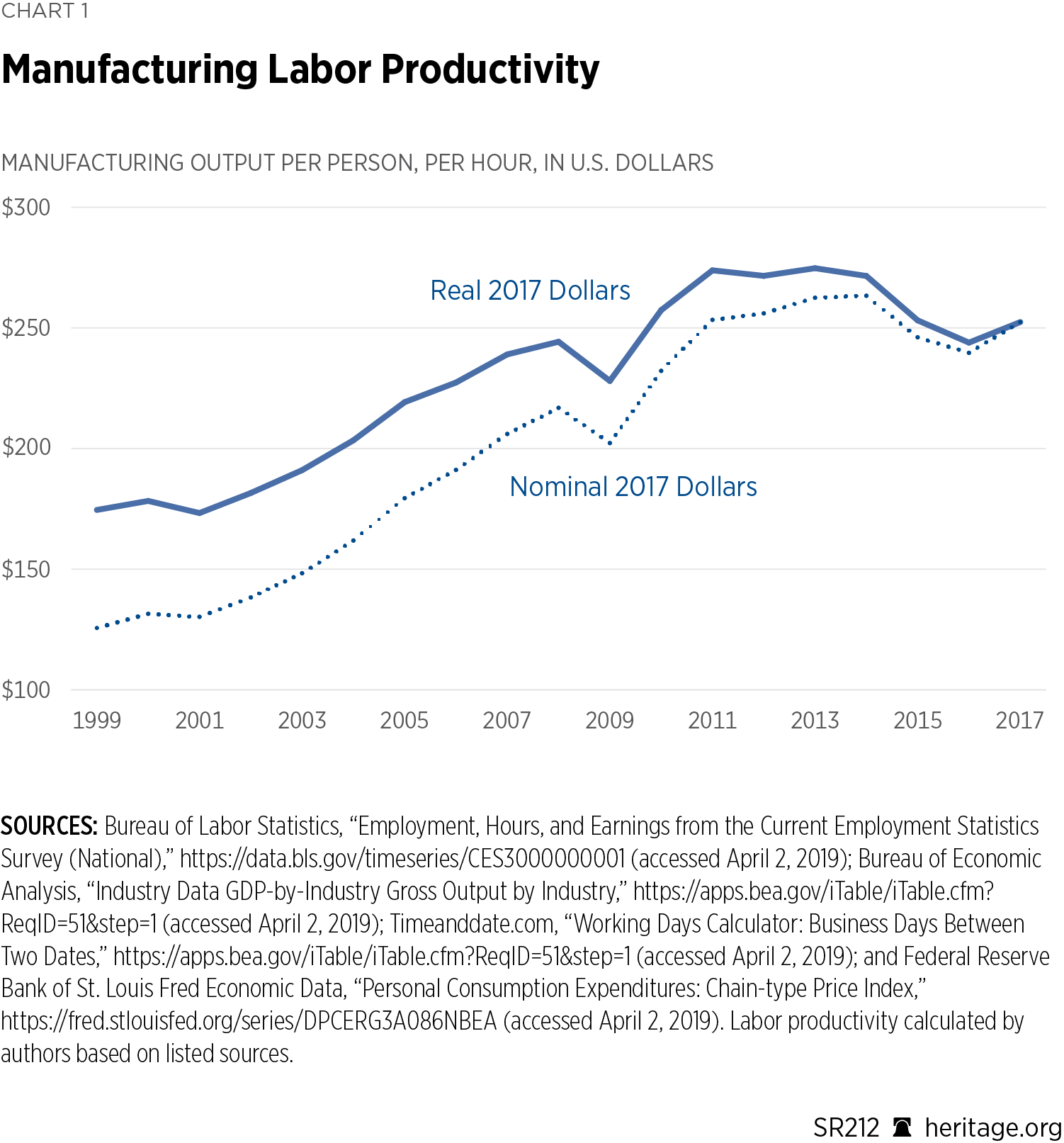

However, it is nearly impossible to draw a direct causal relationship between these employment figures and China’s accession to the WTO in 2001. The more compelling correlation is found by looking at two other factors: manufacturing labor productivity, as shown in Chart 1, and total private-sector employment, as shown in Chart 2. In 1999, one employee in the manufacturing sector could produce $175 worth of output per hour (in 2017 dollars). In 2017, that number was $252 worth of output per hour, an increase of 45 percent.

This means that while fewer Americans are working in manufacturing, they are significantly more productive than before.

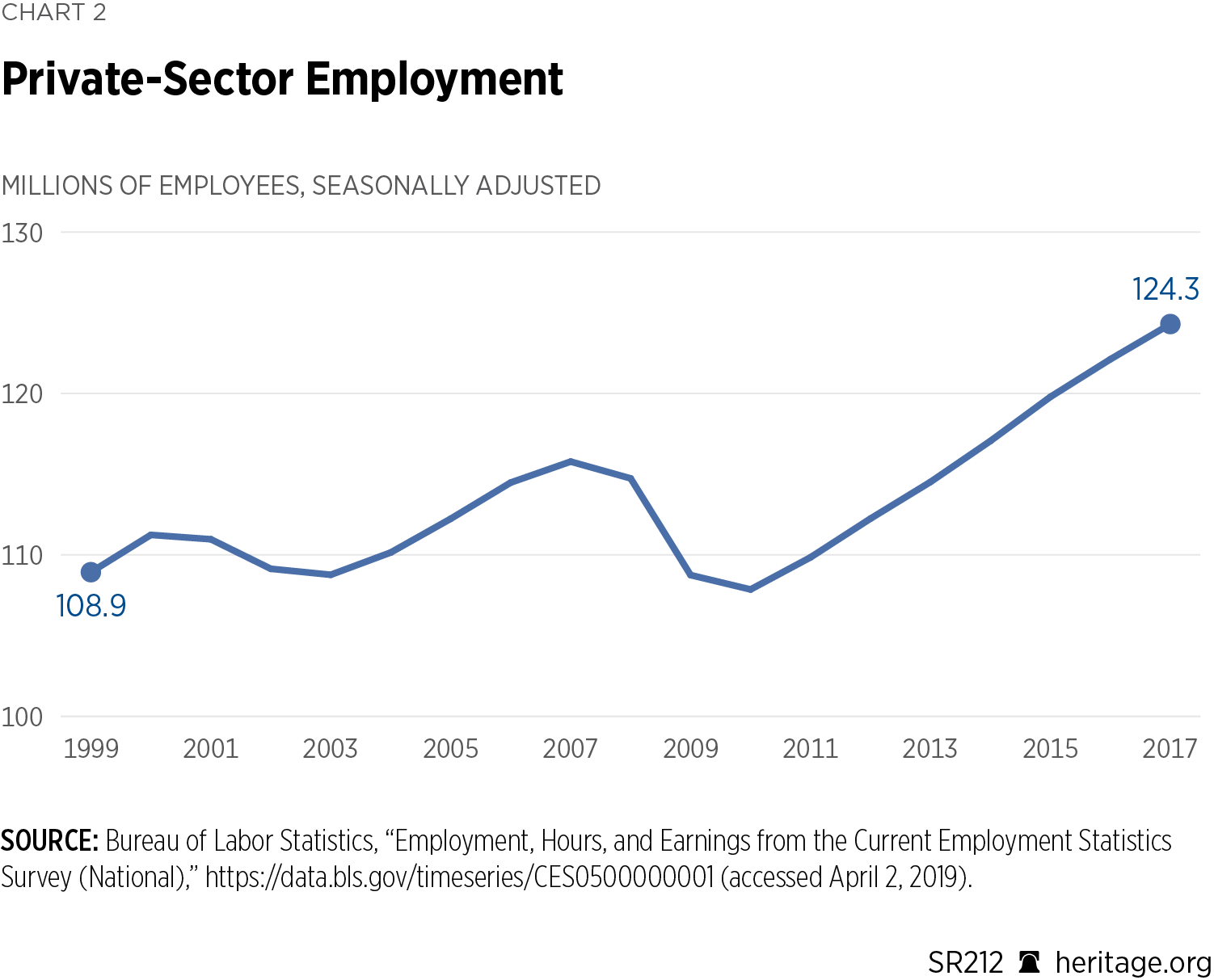

Total private-sector employment also tells a positive story. In 1999, nearly 109 million Americans were employed in the private sector. That number has grown by 14 percent to roughly 124 million Americans.

While employment in manufacturing has decreased, Americans have gained jobs in other sectors of the economy.

Question #2: Is Manufacturing in America Dead?

The idea that American manufacturing jobs and production are disappearing is not a new one, but it has been given new life in recent months. The claim that Americans “don’t make anything anymore” fuels much of the desire for “fair trade” with China and other countries.

Those making this claim often cite the employment data from Question #1, particularly in the manufacturing sector. The line of thought here is that if employment in manufacturing is decreasing, America must not be producing as many manufactured goods.

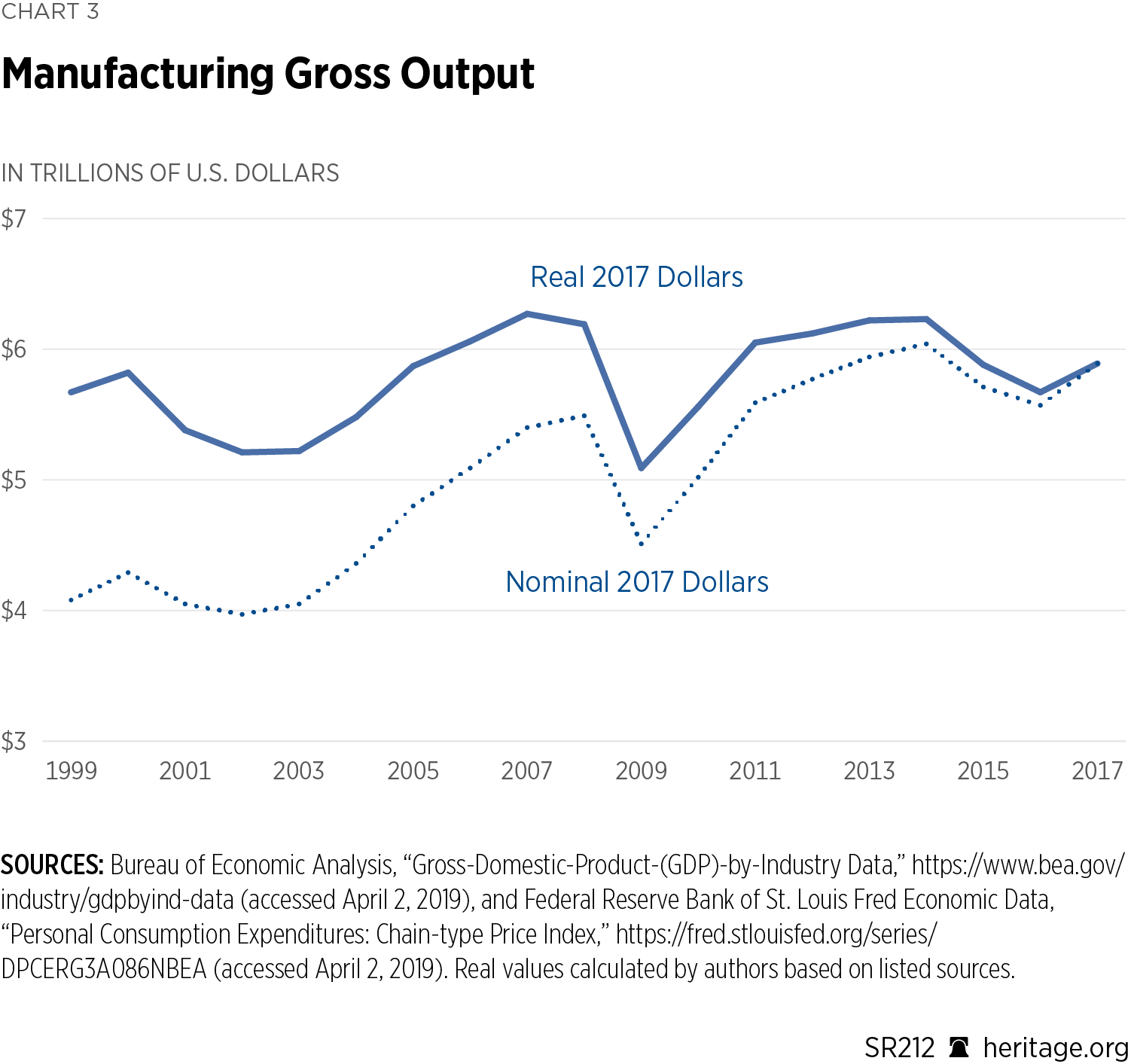

Answer #2: Manufacturing in America is not dead. Employment and productivity only tell part of the manufacturing industry’s story. A look at real manufacturing output in the U.S. in Chart 3 demonstrates that Americans produce a remarkable amount of manufactured goods. Since 1999, real manufacturing output has increased by more than $220 billion.

The manufacturing sectors with the highest levels of real output growth since 1999 are petroleum and coal products (133 percent); chemical products (37 percent); food and beverage and tobacco products (30 percent); and other transportation equipment (26 percent).

Question #3: Is China Dumping Steel into the U.S. Market?

Those concerned about Chinese trade practices often claim that steel from China is dumped into the U.S. market, or that the Chinese government subsidizes the industry. In this context, the term “dumping” is used to describe the action of selling products in the U.S. market that are cheaper or produced below the production cost of those available domestically. Dumped products and materials are not the same as imported products and materials that receive subsidies from the Chinese government, but these two things are often confused.

Answer #3: There are U.S. laws on the books that establish a process to determine whether an import is being dumped or subsidized.9

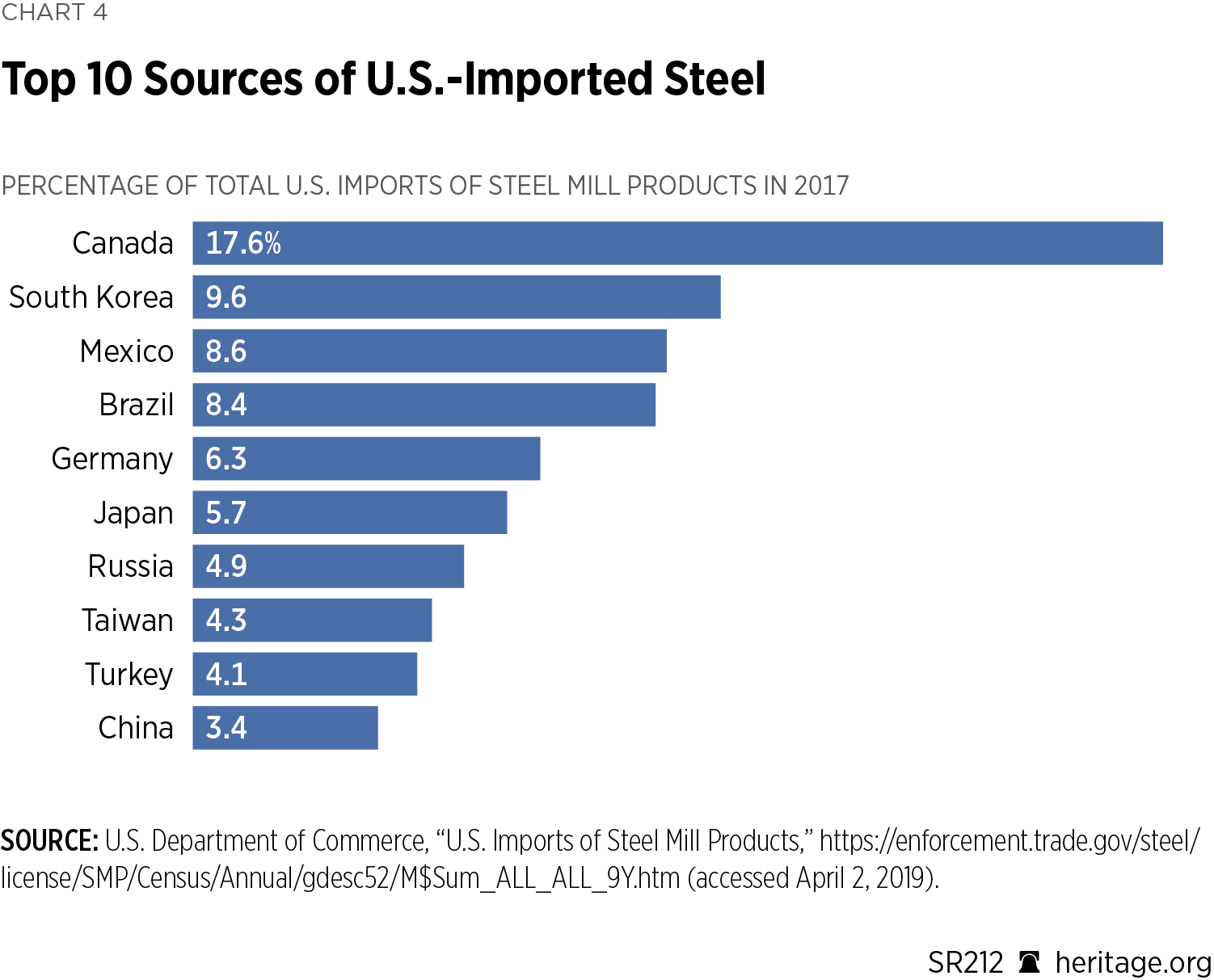

Many imports of steel products from China have been found to be dumped or subsidized, and additional tariffs have been applied for a short period of time. The flaw in the dumping accusation, however, is the claim that a significant amount of steel is still being imported from China. Today, many of America’s top suppliers of steel are close U.S. allies, such as Canada and South Korea. Steel imports from China represent only about 3.4 percent of all U.S. steel imports.

Chart 4 shows America’s top 10 sources for steel imports. Furthermore, when U.S. producers can reduce their input costs by importing, the price of their finished goods are lower. Access to affordable intermediate goods like steel is vital for the global competitiveness of American manufactured goods and exports.

Question #4: Can America Win a Trade Dispute?

The U.S. and China are in the midst of a trade dispute, which has been branded by many as a trade war. This dispute has resulted from China’s alleged unfair trade practices.

The President has argued that “trade wars are good and easy to win,” and that, because China relies on the U.S. economy for its exports, it will back down when threatened with tariffs.

Answer #4: There is no winning in trade disputes. The purpose of tariffs is to make imports more expensive. A tariff is paid by the importer, which is usually an American business. Increased costs to the importer can trickle down through the supply chain making American exports less competitive and increasing prices in stores. As a result, tariffs imposed on goods imported from China hurt Americans.

If Americans have to pay more for the goods they consume every day, that is not winning. Similarly, when China retaliates and imposes tariffs on goods exported to China from the U.S., the same effect is felt by Chinese consumers. Tariffs do not win trade disputes, they only hurt American and Chinese individuals, families, and businesses.

Question #5: Does the Trade Deficit Mean that the U.S. Owes China Money?

Some have claimed that the trade deficit illustrates that America is “losing” at trade because America imports more than it exports, particularly from China. This misconception led to the beginning of a trade dispute, as mentioned in Question #4. One of the Administration’s goals is to reduce the trade deficit by making imports more expensive in the hopes that U.S. businesses will import fewer goods.

Answer #5: A trade deficit is calculated when looking at the trade balance, which is part of the balance of payments. The balance of payments, in its simplest form, is made up of the current account and the capital account. The current account covers the flow of goods and services, while the capital account covers the flow of financial transactions. Technically, a trade deficit is a current account deficit and a capital account surplus, because the two accounts must balance. When one account is negative the other must be positive. Focusing solely on the trade deficit, or current account deficit, does not tell the whole story.

For example, when a U.S. auto company imports a part from China and does not send an export in return, the result is a trade deficit. However, the flow of goods is only half of the story. The capital account—the flow of financial transactions—tells the other half. This includes foreign direct investment. For example, Chinese companies and investors own majority shares in almost 2,400 American companies.

One of those companies is AMC Entertainment.

When investing in the U.S., these Chinese companies and investors are subject to the same rules and regulations as American companies and investors. This type of investment results in a capital account surplus, which counteracts the current account deficit (the trade deficit). This is “a reflection of the fact that foreigners want to invest in America.”

The trade deficit is not causing an American decline; rather, it illustrates America’s growth and attractiveness to investors.

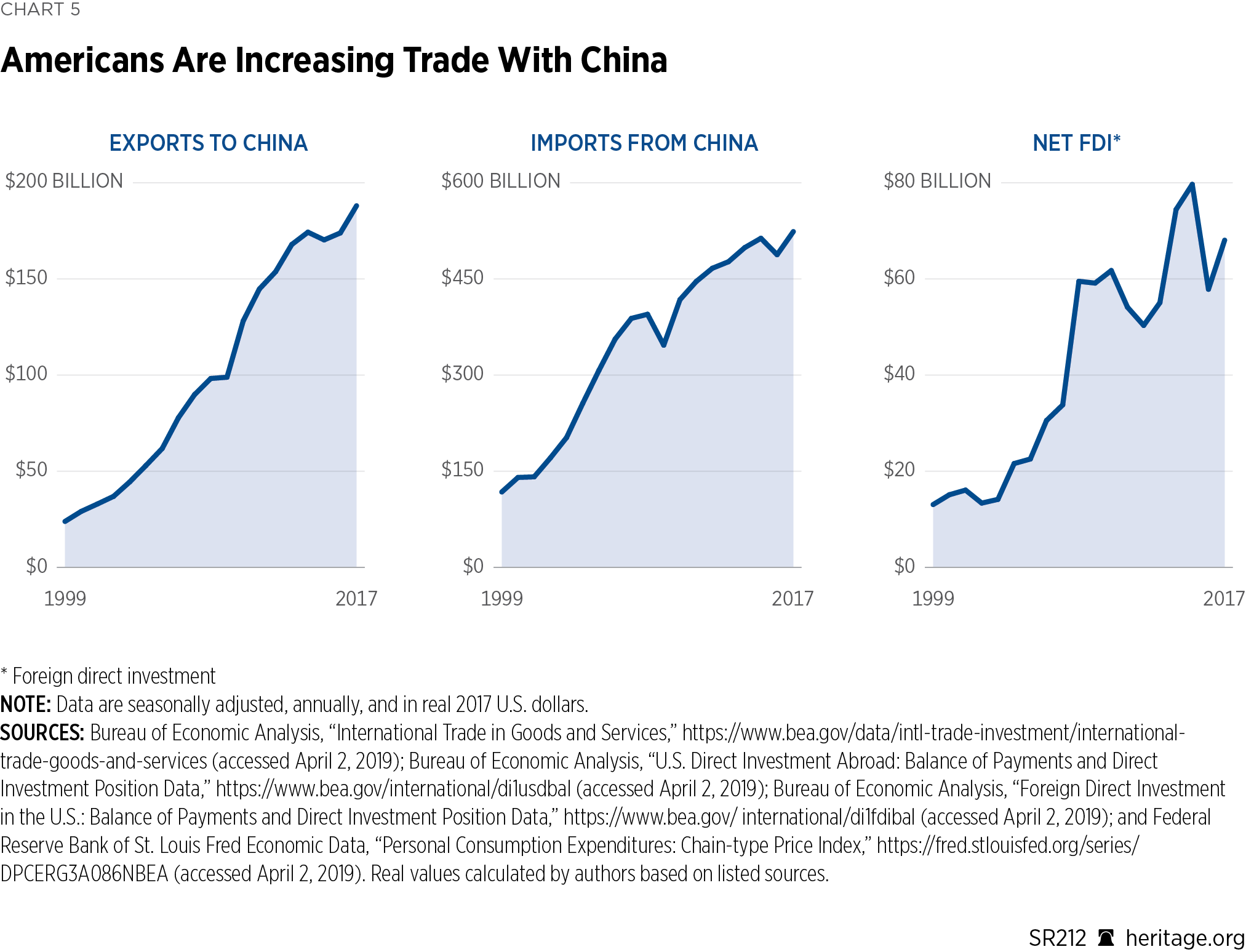

The U.S. imports more than it exports, but it is increasing the number of exports while also increasing the amount of imports, which is a positive sign for the U.S. economy. As shown in Chart 5, since 1999, U.S. exports to China have increased from around $24 billion to $188 billion in 2017.

Chart 5 also shows that imports from China increased from about $118 billion in 1999 to $524 billion in 2017, and that net foreign direct investment (FDI) increased from $13 billion in 1999 to $68 billion in 2017.

Americans are able to enjoy more choices and competitive prices because of trade. Imports are not exchanged for exports. When American businesses import, it is people—not governments—trading with other people. By allowing individuals to trade, they have greater access to different prices and qualities of goods.

Question #6: Does China Needs Us More Than We Need Them?

A popular justification for the Administration’s tariff strategy against China has been rooted in the argument that the U.S. trade deficit with China means that China needs the U.S. more than the U.S. needs China. In simple terms, the claim is that because China has an export-driven economy and the U.S. economy is larger than China’s, the Chinese have more to lose if the trade dispute continues.

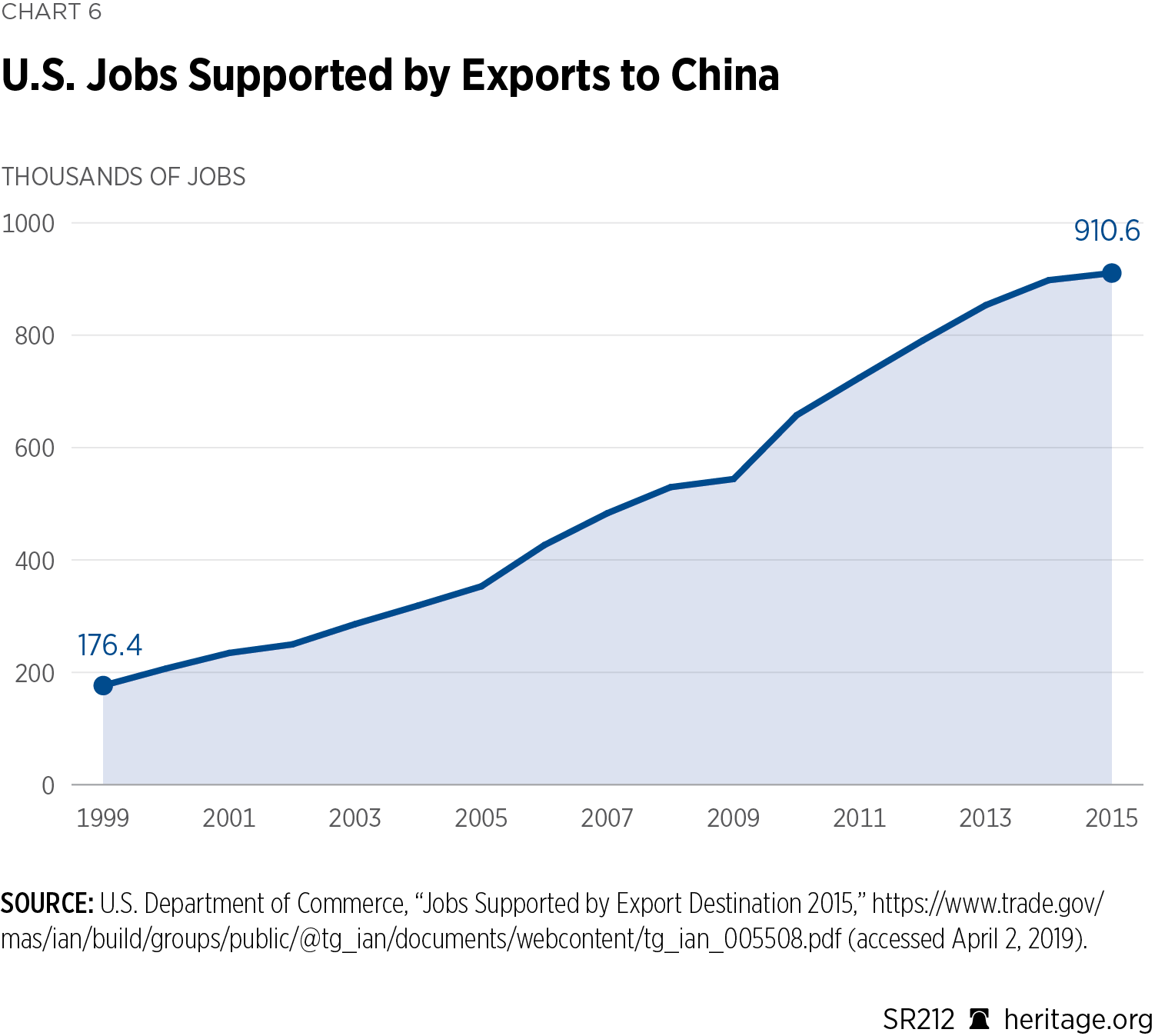

Answer #6: On its face, this claim seems to make sense, but it fails to take into account all of the evidence from Answer #5, which shows that trade with China is mutually beneficial. Furthermore, it fails to acknowledge the growth in the number of American jobs tied to trade with China. As shown in Chart 6, in 1999, the jobs of roughly 176,000 Americans were tied to exporting products to China. That number has exploded since then, totaling more than 900,000 jobs in 2015.

FDI from China also supports jobs here in America. In 1999, roughly 2,500 Americans were employed by Chinese-owned companies; in 2015, that number was 45,800.

It would be a grave mistake for the Trump Administration to neglect the importance of trade with China for Americans, not only regarding their freedom to trade, but also for their jobs that exist because of this relationship.

Question #7: Does China Still Have High Trade Barriers?

For months, a narrative has taken hold that America’s trading partners are taking advantage of the U.S. Oftentimes, justification for this claim is made by referencing not only the overall trade deficit, but the individual trade deficit with each partner, as discussed in Question #5. Advocates of the current tariffs on Chinese imports compare average tariff rates between the two countries, as well as non-tariff barriers. The line of thinking is that if China’s barriers are higher than those in the U.S., the U.S. is justified in increasing its barriers as a penalty.

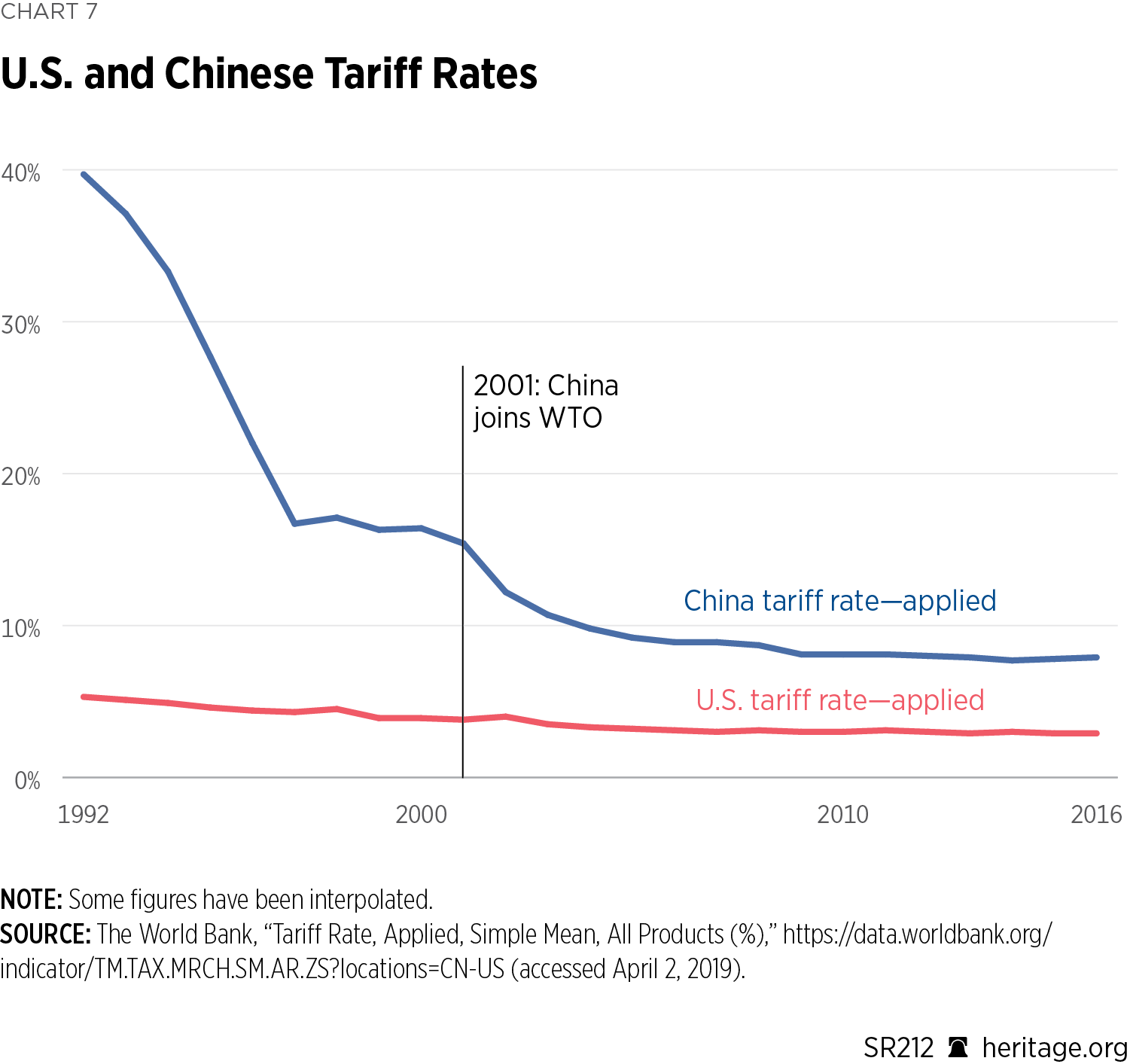

Answer #7: It is true that China has higher tariff barriers than the United States, and in many cases the non-tariff barriers are also higher. However, this fact alone does not take into account the significant progress that has taken place to lower China’s tariff barriers. In 1992, China’s average tariff rate, the rate at which China charges its people to import from abroad, was roughly 40 percent, as illustrated in Chart 7. This rate decreased significantly over the next 10 years, and was about 15 percent when China joined the WTO in 2001.

Since its accession, China has lowered its tariffs even further to just under 8 percent. It would be a mistake to overlook this significant improvement, but there is certainly room for more.

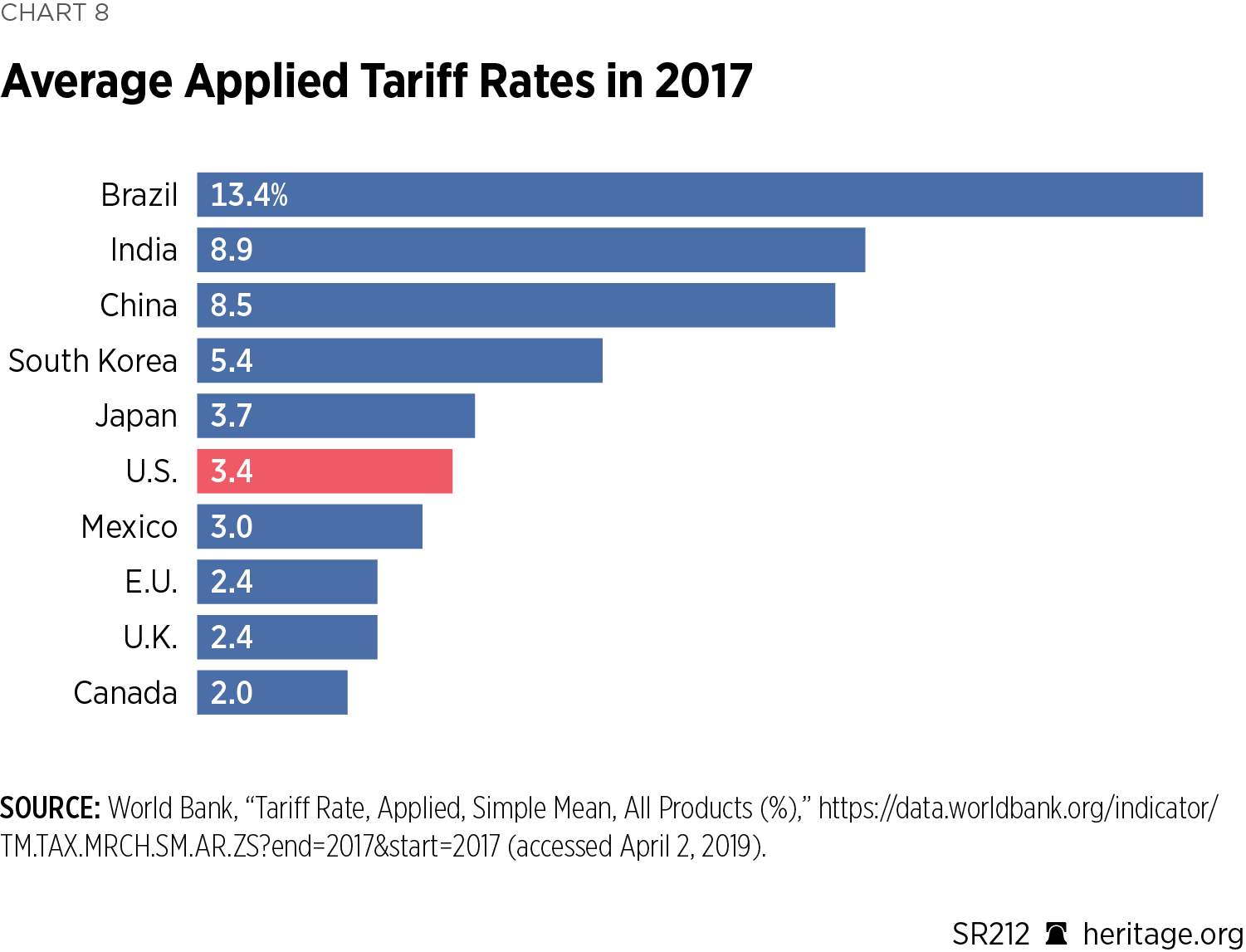

When compared to other top trading partners of the U.S., China’s average tariff rate lands somewhere in the middle of the pack. Chart 8 demonstrates that Brazil and India have higher average tariff rates than China, while South Korea and Japan have lower average tariff rates than China, but higher than the U.S.. Mexico, the European Union, the United Kingdom, and Canada have slightly lower average tariff rates than the U.S.

Trade barriers should be zero in all countries, including the United States. Even President Trump acknowledged at the G7 Summit in Canada in early 2019 that he wanted to see trade that is free of tariffs, non-tariff barriers, and subsidies.

While China has many burdensome non-tariff barriers, it is difficult to measure those barriers. Any remaining trade restrictions in China affect the freedom of Chinese people and businesses more than any other country. Restricting economic activity is a tool used by the communist government in China to control the economy, preventing the Chinese population from experiencing the full benefits of the world economy.

Heritage Foundation researchers examine trade freedom throughout the world as part of the annual Index of Economic Freedom. In the 2019 Index, China received the highest penalty for non-tariff barriers, meaning that non-tariff barriers are “used extensively across many goods and services and/or act to impede a significant amount of international trade.”

So far, the Trump Administration’s efforts to force China to reduce these barriers, many of which occur in the form of government subsidies, have been unsuccessful.

Question #8: Is the World Trade Organization Effective Against China?

White House officials have repeatedly claimed that the WTO is ineffective in addressing China’s violations of its WTO obligations, such as the commitment to respect intellectual property rights in the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS). Critics have also claimed that China does not comply with WTO dispute-settlement recommendations when it is found to be incompliant with its agreements.

Answer #8: Since 2004, the U.S. has won 100 percent of the cases it has litigated at the WTO against China. In these situations, China has complied with dispute outcomes in all cases but one, where China partially complied.

During an event at The Heritage Foundation, James Bacchus, former chairman of the Appellate Body of the WTO, said, “There are many WTO rules that right now offer opportunities for us in engagement with China in dispute settlement. And we should proceed with even more dispute settlement against China in the WTO.”

He specifically cited using TRIPS and China’s accession agreement as mechanisms for bringing cases on issues, such as loss of trade secrets, technology transfer, and protection of intellectual property. The WTO process works for America, and the Trump Administration should continue to pursue disputes as needed.

Question #9: Is it in China’s Interest to Sell Off Large Amounts of Its Foreign Exchange Reserves?

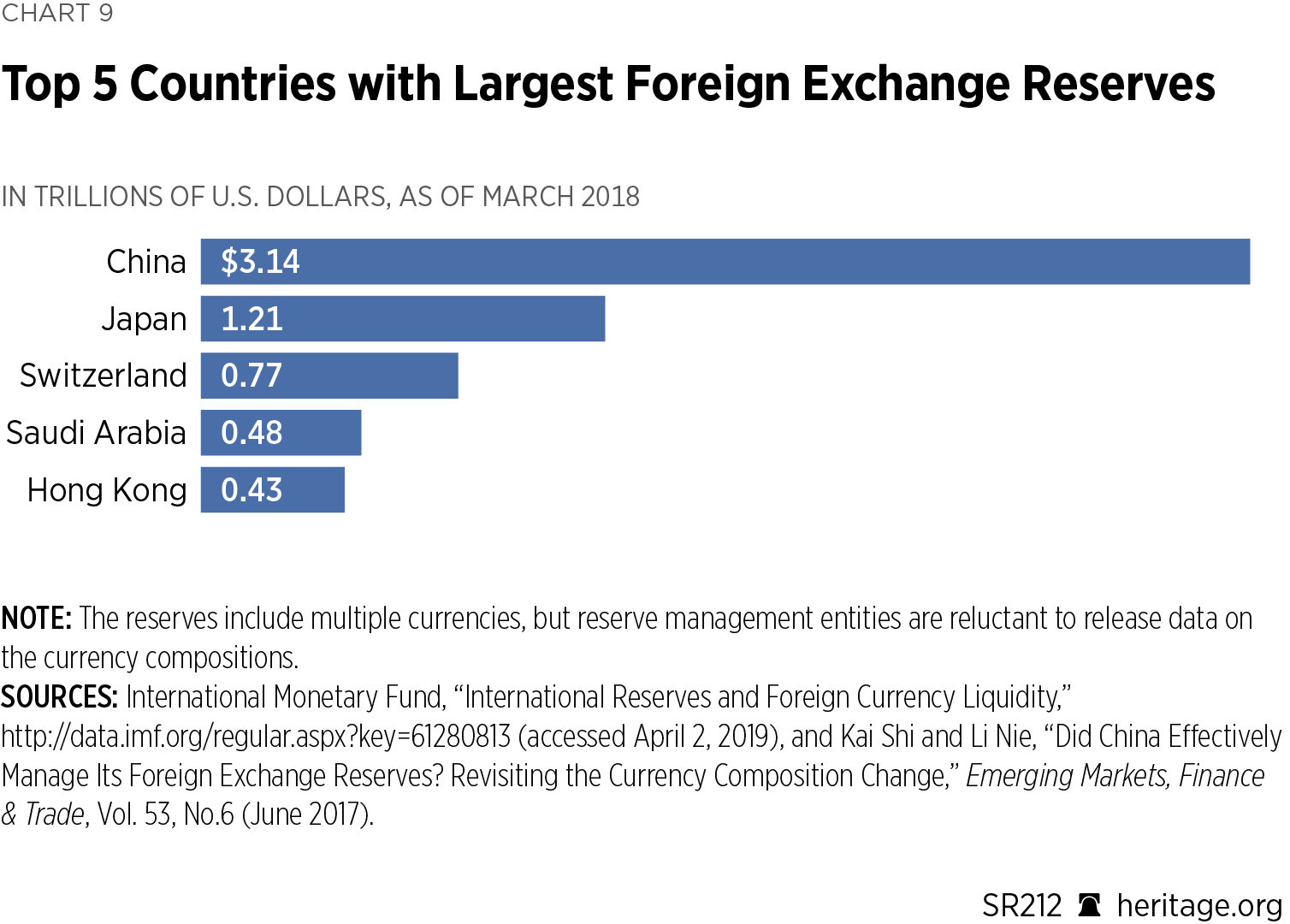

China has about $3.1 trillion in foreign exchange reserves, as illustrated in Chart 9.

These reserves include multiple currencies, but reserve management entities are reluctant to release data of the currency compositions.

There are concerns that China’s ownership of U.S. dollars would enable China to influence the value of the dollar. The fear is that this would disturb the U.S. and global economies, as the dollar is the preferred medium of exchange for international trade.

Foreign exchange reserves are different from the debt holdings, which will be discussed in Question #10. However, countries can have debt holdings as part of its foreign exchange reserves. Foreign exchange reserves are the assets held on reserve by a country’s central bank in foreign currencies.

Debt holdings are debt, such as bonds, held by individuals, corporations, state, local, and foreign governments.

Answer #9: It is not in China’s interest to sell off large amounts of its foreign exchange reserves because it would lose the insurance that foreign exchange reserves provide. China’s large volume of foreign exchange reserves—equivalent to approximately $3 trillion—is largely a consequence of China’s substantial volume of exports. When people from foreign countries buy goods from China, they do so using their own currencies. However, Chinese sellers need yuan—not foreign currencies—to conduct local business. As a result, a portion of these foreign currencies end up at the central bank.

For instance, when finished goods are exported to the U.S., American firms pay Chinese exporters in U.S. dollars. These Chinese exporters, in turn, have limited options for using those U.S. dollars. They can hold some of the dollars for future dealings with foreign businesses, invest some of the dollars directly in U.S. assets (including U.S. Treasury securities), exchange these U.S. dollars for yuan at their local banks, or a combination of the three.

When Chinese companies exchange the dollars for yuan, banks send (at least some of) those dollars to China’s central bank, the People’s Bank of China. The Chinese central bank, in turn, stockpiles those dollars in its foreign exchange reserves. This action reduces the supply of dollars in the Chinese economy, which, all else constant, increases the value of the dollar relative to the value of the yuan.

Foreign exchange reserves serve many purposes but are similar to a savings account that the central bank can use when certain situations arise. China’s economy depends on trade and it needs a large reserve of dollars to serve as a type of insurance. During emergencies, such as natural disasters, national currency devaluation, or in the worst case, currency insolvency, China has dollars reserved so that it can continue to trade.

Finally, the foreign reserves held by the central bank reassure foreigners who invest in the Chinese economy. The central bank will buy local currency to maintain market stability and prevent inflation. The reserves can be used to inhibit economic crises by providing protection for investors so that they do not rapidly move money or capital out of the country.

Therefore, it is not in China’s interest to sell off large amounts of its foreign exchange reserves.

Question #10: Can China Use Its U.S. Debt Holdings as a Trade Weapon?

In retaliation to the tariffs imposed on imports from China, U.S. officials were concerned that China would sell off the U.S. debt that it holds.

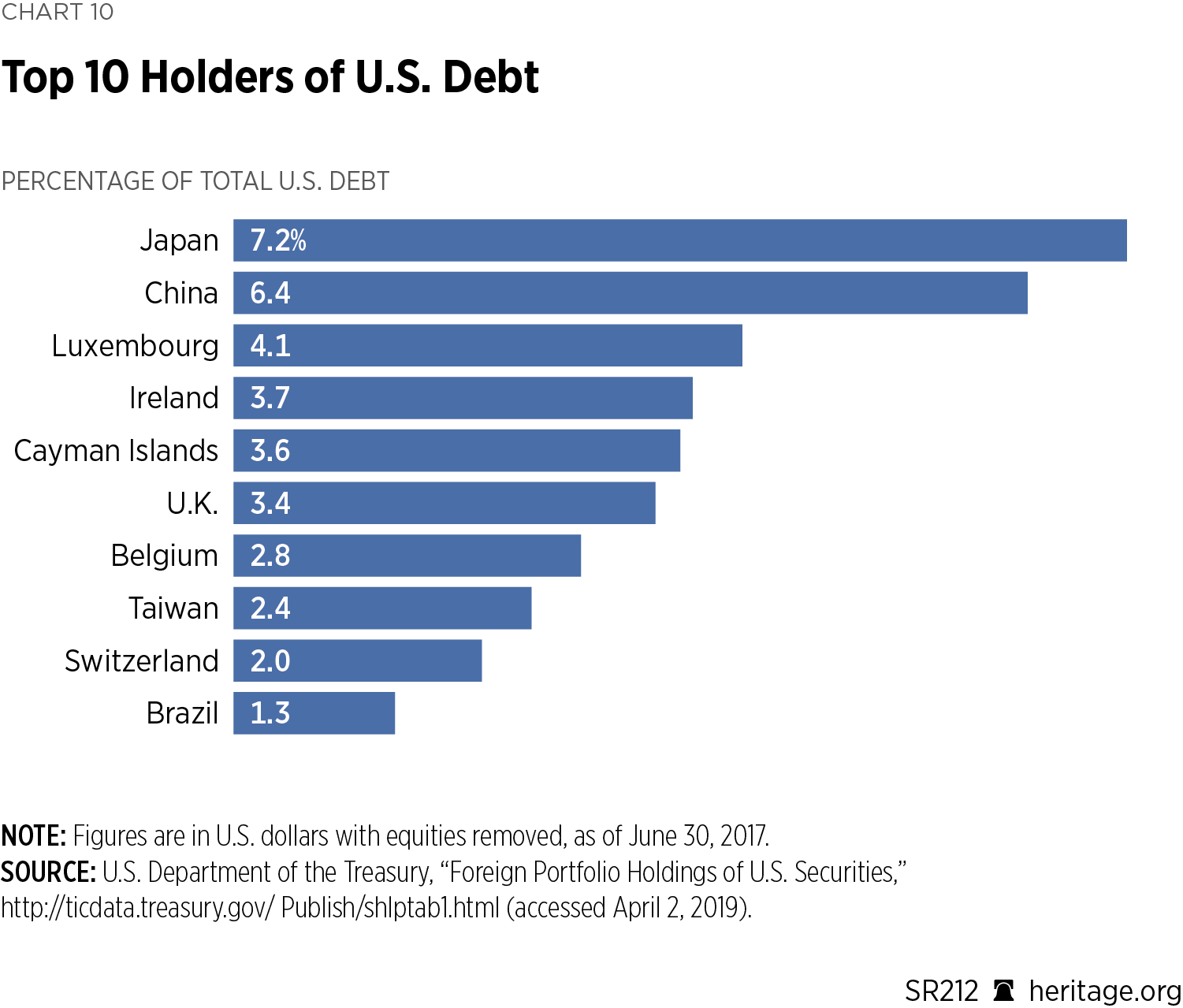

Answer #10: U.S. citizens, foreign nationals, and foreign governments buy U.S. debt. When foreigners buy U.S. debt, it means Americans do not have to foot the bill, freeing up cash for domestic investment. These foreign purchases have also helped to keep U.S. real interest rates low because purchases of U.S. assets increases the demand for U.S. assets.

China’s ownership of U.S. debt does not give it leverage over the United States because “American debt is a widely held and extremely desirable asset in the global economy.”

If China offloaded significant amounts of the debt, it would reduce the value of China’s remaining dollar holdings, negatively affect the renminbi exchange rate, and quickly be purchased by other countries.

As discussed in Answer #9, Chinese exporters, banks, and the central bank can all use dollars (received via international trade) to buy U.S. debt. China and other countries hold large amounts of U.S. debt. As illustrated in Chart 10, as of June 2017, China collectively owned 6.4 percent of outstanding U.S. debt, but the largest holder was Japan.

It is not in the interest of countries to aggressively offload debt, as it can disrupt their economies because of its importance in trade relations. For instance, rapidly reducing the value of the dollar relative to the renminbi (by dumping its U.S. debt holdings) would make Chinese exports to the U.S. more expensive, thus harming Chinese exporters.

Question #11: Is China’s Economy Bigger than the U.S. Economy?

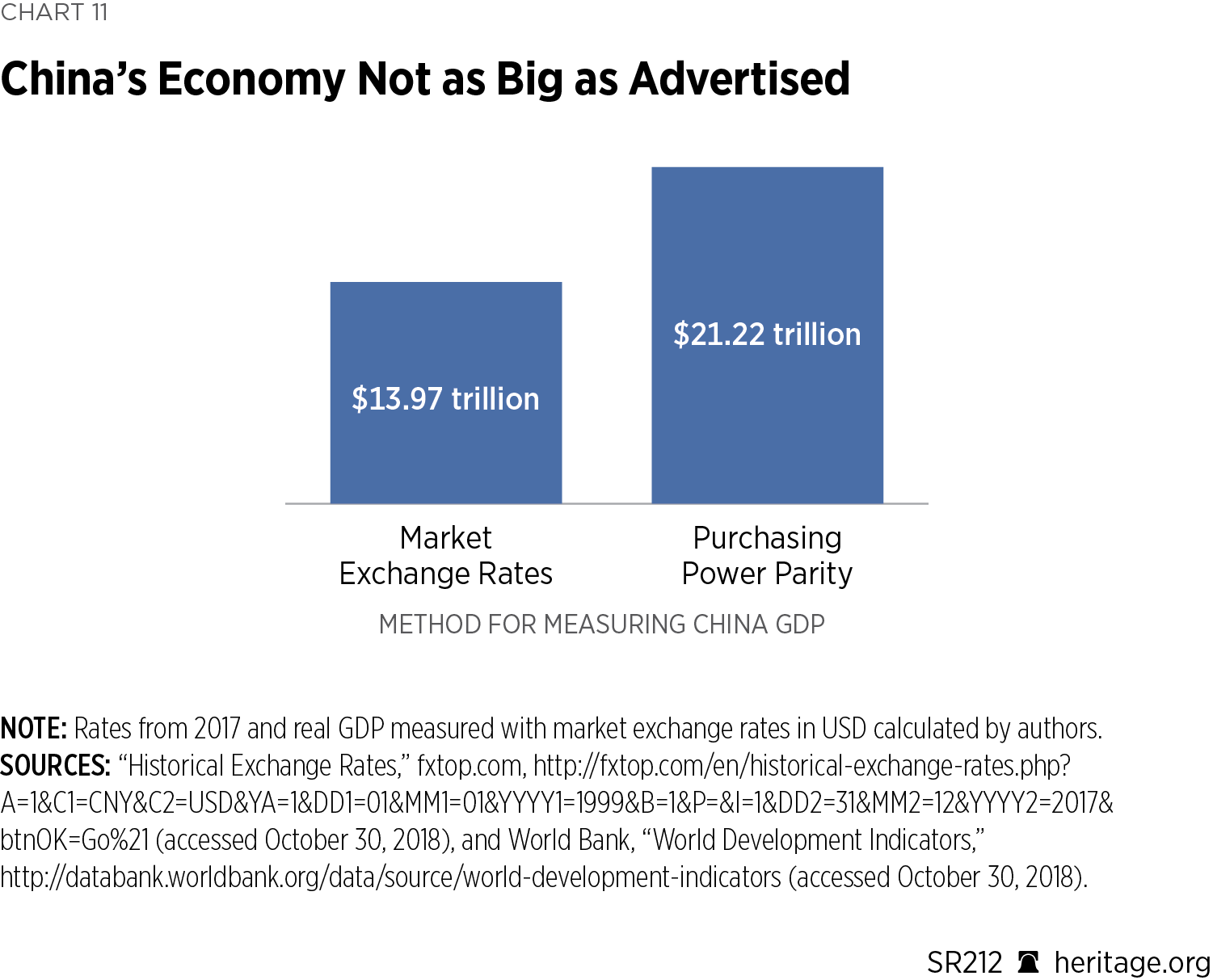

China’s nominal gross domestic product (GDP) was around $23 trillion in 2017.

After accounting for inflation, China’s real GDP in 2017 was around $21 trillion. This indicated that China had overtaken the United States as the world’s largest economy.

Answer #11: China’s economy is not as big as often advertised because of the use of purchasing power parity (PPP) exchange rates. The PPP method shows China’s GDP as if China had the same cost of living as the United States, which it does not. To compare the sizes of the economies, it is better to use the regular market exchange rates. This method adjusts for standards of living by simply converting China’s GDP in yuan to U.S. dollars the same way that people convert their currency when they visit another country.

When using exchange rates, China’s real GDP is calculated to be around $14 trillion in 2017, not $21 trillion. This is shown in Chart 11.

GDP is the most common measure for estimating the size and growth of a country, and it is often calculated using the expenditure method. This method illustrates a country’s capacity to spend by summing how much people spend domestically, how much the government spends, how much is invested, and the value of net exports. It is important to note that net exports are used because expenditure on imports is included in consumption, investment, and government expenditure, so it must be subtracted to avoid double counting.

When solely comparing the sizes of economies of different countries, the market exchange rate conversion for GDP indicates the extent to which a country could disrupt global markets. It illustrates how much was spent in that country in that year on consumption, investment, government spending, and net exports. This is important to observe as those countries with larger GDPs tend to have greater economic footprints on the world economy. It illustrates how much a country could potentially change world market demand or supply because it demonstrates the buying and selling power of that country.

When countries trade with one another, they use market exchange rates to convert their own currencies to the currencies that they need. For example, when an American automaker imports parts from China, the U.S. company pays the Chinese company in U.S. dollars based on the market exchange rate. When an American farmer exports soybeans to China, the American must accept payment in Chinese yuan at the market exchange rate. When solely comparing size, GDP converted using market exchange rates more accurately illustrates the buying and selling power of the citizens in that country, as it shows how much they actually spent in that year.

Conclusion

Trade is not a zero-sum game. The freedom to trade with China is important for the American people because it increases competition, innovation, and choice in the marketplace. The trade discussion is often polluted with hyperbole and rhetoric, making it more important than ever to be equipped with the facts and supporting data. The questions answered in this Special Report should help to guide policy to increase trade liberalization so that both American and Chinese individuals and families can enjoy greater levels of economic freedom and prosperity.

[To read the original report, click here.]

Copyright © 2019 The Heritage Foundation. All rights reserved.