China’s top leader Xi Jinping makes a point of reminding his audience of the time after the Opium War (1839-42), when China was “gradually reduced by foreign powers to a semi-colonial, semi-feudal society that suffered greater ravages than ever before”, bringing “intense humiliation for the country” and “great pain for its people” (Xi Jinping 2021).

There are different ways of evaluating the West’s foray into China following the Opium War. In terms of human casualties, for example, domestic civil war during China’s tumultuous 19th century, such as the Taiping Rebellion (1850-64), dwarfs the number of casualties caused by the Opium War, perhaps by a factor of 1,000.1 In terms of economic conditions, it is evident that the time from 1840 to 1900 was much worse than the time of China’s rapid economic progress in the later part of the 20th century. Yet, there is no consensus on the economic impact of the West’s 19th century intervention in China, and specifically, whether it harmed China’s economy.

Generally, it is held that although Western colonialism was associated with both destructive and modernising influences in China, on the whole Western impact was limited one way or another. The main reason for this, it is argued, is that Western influence was limited to some dozens of ports that were scattered over a very large country (Murphey 1974, Fairbank 1978).

In a new paper (Keller and Shiue 2021), we revisit the economic impact of the West’s intervention in China during the 19th century. The Treaty of Nanjing in 1842 and subsequent treaties forced China to open dozens of cities to Western traders, dramatically ending centuries during which China developed in relative isolation from the West. These so-called treaty ports were notable because it was from these claimed areas that Western countries abolished Chinese practices in trade and reorganised them under their management. Moreover, Western-style courts and legal practices were introduced in China at foreign consulates that practiced extraterritoriality, that foreigners in China would be tried according to their home country laws instead of China’s laws. Starting in the year 1854 Westerners also managed China’s customs system through the Chinese Maritime Customs Service.

Figure 1 shows the evolution of Western influence in China during the 19th century. We see that the opening of treaty ports and consulates tracked each other closely, while the establishment of customs stations typically lagged by a couple of years. By the end of the 19th century, treaty ports, consulates, and customs stations were located in about 30 prefectures (just under 10% of all Chinese prefectures).

Figure 1 Evolution of foreign influence in 19th century China

We estimate the impact of Western influence by comparing outcomes in Chinese regions with treaty ports, consulates, or customs stations and regions without them using annual data for the years 1821 to 1899. Reliable income figures for this period are not available. Instead, we obtain regional interest rates, a measure of local capital costs, using an asset-pricing approach with grain prices.2 We also evaluate the Western impact in terms of the growth of Chinese banks, industrial firms, as well as technology adoption. Our analysis accounts for the role of non-Western countries such as Japan and Russia, for the influence of missionaries, and also for the impact of events of mass violence such as the Taiping Rebellion.

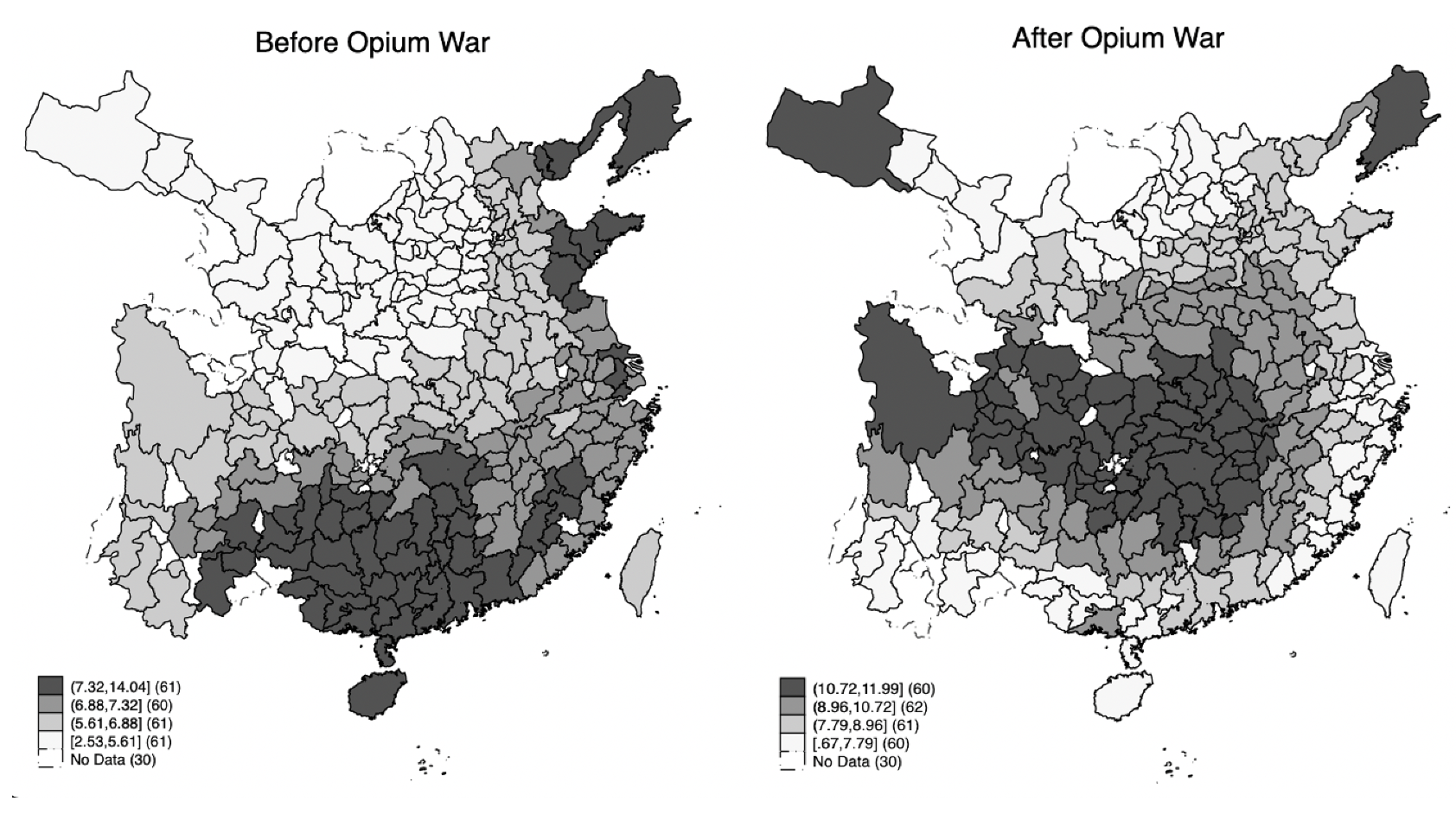

Figure 2 presents initial evidence that Western imperialism was accompanied by a deep change in the structure of China’s capital markets. Whereas before the Opium War, northern inland areas were of key importance and had the lowest interest rates (left panel), the arrival of Western traders shifted the focus to China’s coast, especially in the south, and interest rates tended to be low in these regions (right panel). Before the Opium War, inland areas tended to be more important than the coast. Both Suzhou and Hangzhou, for example, were larger and more important than Shanghai and Hong Kong, and while those cities were not far from the coast, neither were they located with direct coastal access.

Figure 2 Interest rate patterns in the Chinese economy

A plausible explanation for this regional shift is that the treaty port system of the West put more emphasis on coastal locations and on the international trade that aided the interests of Western countries. Figure 2 is in line with other work emphasising deep structural changes brought about in China through Western influence (e.g. Pomeranz 1993).

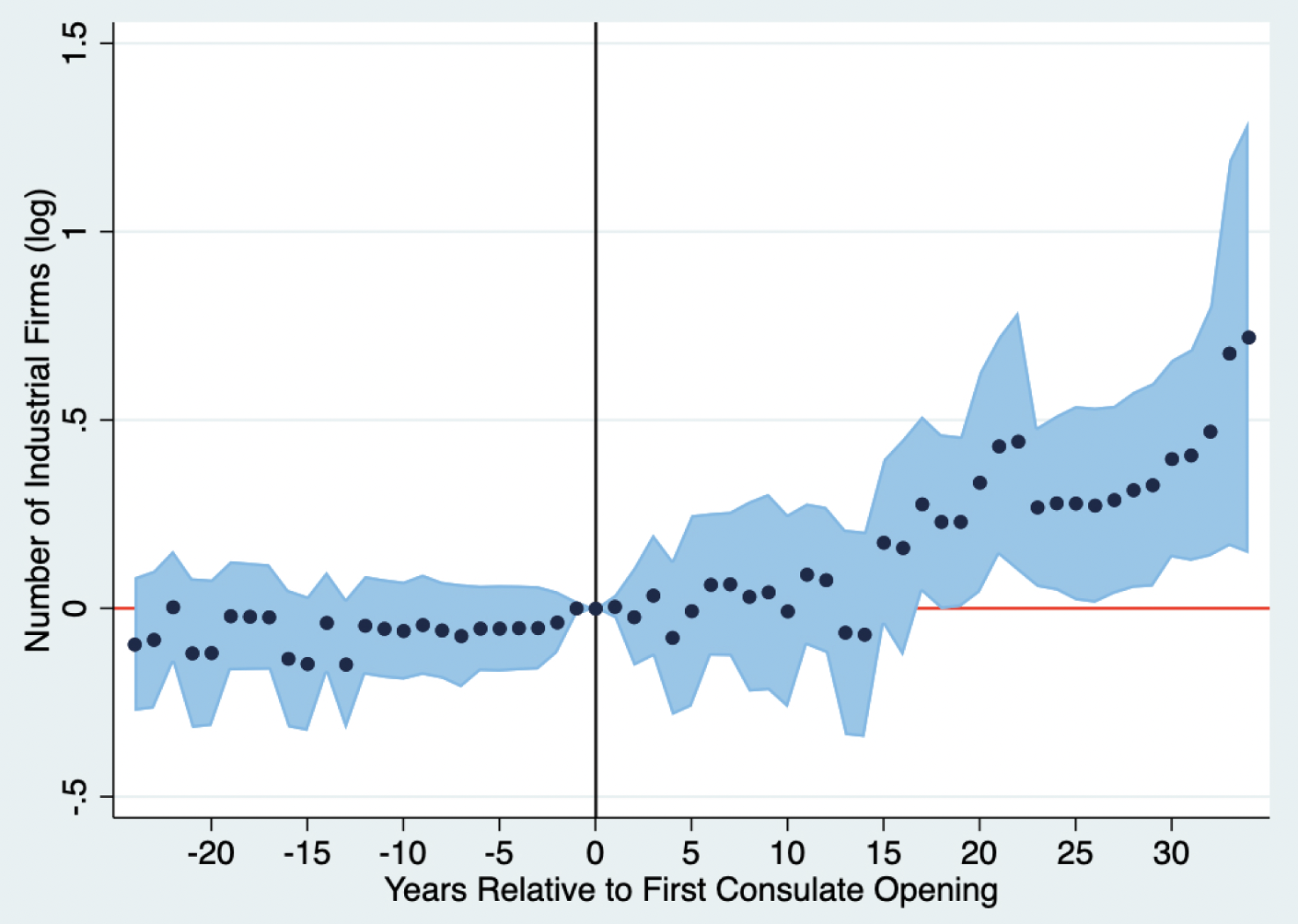

We estimate the causal impact of the West with a difference-in-differences approach in an event-study setting. Figure 3 shows the impact of the West on the number of industrial firms for a window of 60 years before and after the opening of Western consulates. Controlling for a range of factors including year and prefecture fixed effects, Figure 3 shows a positive impact of Western influence on industrial firm growth. Also notice that there is no evidence for differential pre-trends in the sense that none of the coefficients before t = 0 is significantly different from zero.

Figure 3 The impact of Western influence: Event-study evidence

In addition, we find that Western influence increased the number of banks, firm investment, as well as the adoption of steam engines and industrial machinery. Western influence also had a positive impact on local interest rates in that it significantly lowered them, and much of the interest rate-lowering effect is due to lower risk and security spillovers as opposed to a larger supply of capital. In addition to this treaty port effect, we find evidence for a separate legal channel of influence associated with foreign consulates.

We examine the size of the Western impact on China’s economy by performing a geographic spillover analysis.3 To do so, we extend the difference-in-differences analysis by adding Western influence variables based on circular bands (‘doughnuts’) at particular distances away from the treaty ports and foreign consulates. If the Western impact were small, any reduction in the interest rate would have been confined to the immediate treaty port areas. The larger the impact, the greater would be the reduction in interest rates, and the further this reduction would be felt, permeating not only the areas near the treaty ports, but also the surrounding geographic areas.

We find that interest rates fell by more than a quarter in the immediate vicinity of the ports and by almost ten percent even at distances of up to 450 kilometres from treaty ports. This decay of the effect with geographic distance is plausible not only because capital market transactions become less frequent with geographic distance since distance is a barrier to the mobility of people, but also because the diffusion of new ideas exhibits spatial decay since knowledge is not perfectly codifiable and thus facilitated by in-person demonstration (Jaffe et al. 1993, Keller 2004).

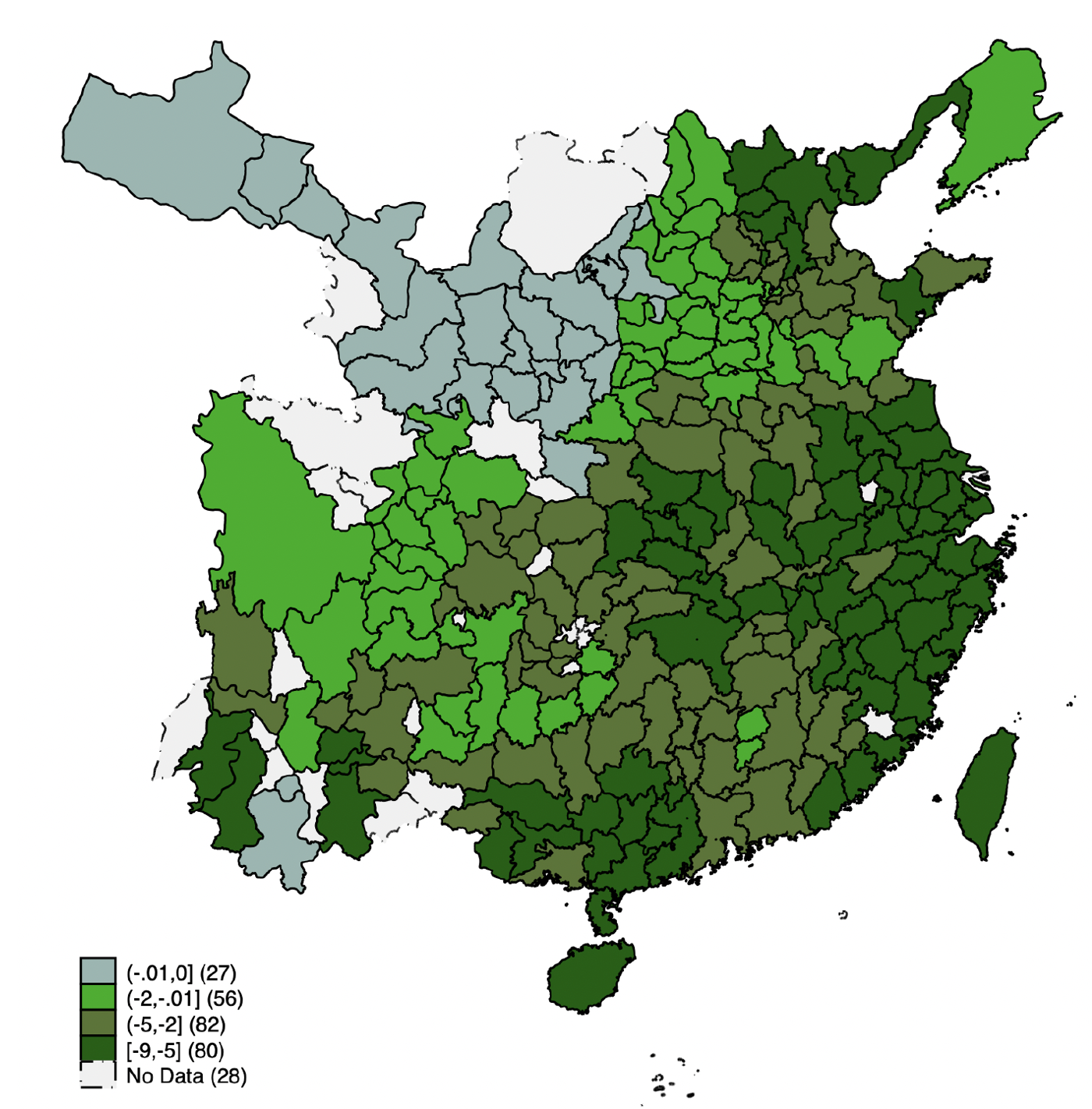

Plotting the predicted effects for the late 19th century on a map of China yields Figure 4. The darker the colour, the larger the predicted interest rate-lowering effect. Notice that interest rate reductions were particularly large in areas with substantial Western influence, such as in the coastal areas of Jiangsu and Zhejiang provinces, as well as around Guangzhou in the South. At the same time, the geographic reach of Western influence went far beyond the immediate vicinity of treaty ports. In fact, in only 11% of our regions do we not estimate an interest rate lowering effect, and in three quarters of regions did Western influence lower the interest rate by more than 25% (at least two percentage points relative to an interest rate average of about 8%).

Figure 4 Western influence and Chinese capital markets in the treaty port era

Figure 4 shows that the West impacted China’s economy in the majority of the country’s regions during the treaty port era.

In sum, we show that Western intervention in the 19th century had a substantial role in creating China’s economy today. Offering the year 1842 as the turning point that explains the Chinese economy we see today pre-dates 1921 (foundation of the Communist Party of China), 1949 (foundation of People’s Republic of China), and 1978 (beginning of market reforms). The development of China was not simply propelled by its own pre-1800 history, or by post-1978 reforms. The nearly 100 years of semi-colonisation have shaped China’s economy today as one focused on the coastal areas.

Wolfgang Keller is Director of the McGuire Center for International Economics and Professor at the University of Colorado-Boulder.

Carol H. Shiue is a Professor of Economics at the University of Colorado at Boulder, an NBER Research Economist, a CEPR Research Affiliate. She received a BS from the Massachusetts Institute of Technology and her PhD from Yale University. She has also held visiting appointments at Princeton University, CesIfo, and the Russell Sage Foundation.

To read the full commentary from Vox EU, please click here.