Conflict between China and India has made it urgently necessary for the US to deepen its economic integration with the latter country, through increased trade and investment. On June 15, 20 Indian soldiers and an unknown number of Chinese soldiers were killed when the two countries clashed over a disputed border. In response, India banned a number of Chinese apps. As my Bloomberg Opinion colleague Mihir Sharma points out, these conflicts are likely to drive India closer to the US in strategic terms.

But that budding alliance will be harder to cement without deeper economic ties. Not only does trade tend to cement alliances, but building up allied countries’ economies makes them much more able to resist military encroachments by rivals. The US once understood this; the Marshall Plan famously helped stabilize Western Europe after World War II and prevent it from falling into the Soviet orbit, while opening US markets to Japanese, South Korean and Taiwanese products helped those countries industrialize.

In recent years the US seems to have forgotten this lesson. Opposition to the Trans-Paci c Partnership largely ignored the geopolitical importance of that treaty, which would have created an Asian trade bloc to rival China. Now, with the US-China rivalry heating up, let’s hope the US will remember the importance of trade and investment as tools for cementing alliances. And the most important ally will almost certainly be India.

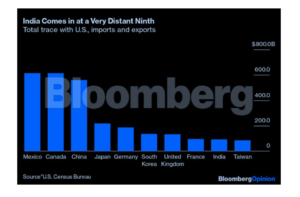

Deepening the economic partnership with India will be a long and difficult road. India now is only the US’s ninth most important trading partner, barely ahead of tiny Taiwan:

A trade deal between the two countries could boost this number. But even a minor agreement fell through earlier this year. True to form, the Trump administration has been refusing to allow India duty-free access to US markets unless India opens its agricultural sector to US exports. Because India is still a largely rural, agrarian economy, demanding that the country put hundreds of millions of poor farmers at risk of being displaced by US agribusiness was always a non- starter.

A future administration should be more sensitive to India’s needs and vulnerabilities. Opening US markets to Indian- made goods, even with no reciprocal opening by India, makes geopolitical sense. Having the US as a stable source of demand for manufactured products would also help India to build up its industrial sector in the same way that China and South Korea did. And it would be unlikely to increase the trade de cit or put US workers out of a job; instead, it would result in some companies shifting labor-intensive manufacturing out of China into India, as is now happening with Vietnam.

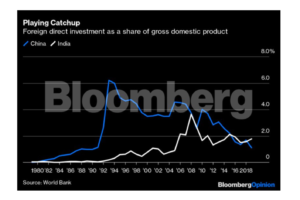

An even more beneficial economic relationship, however, would be increased direct investment by the US into India. China famously bolstered its economy by relying heavily on foreign direct investment — as the workshop of the world, it invited companies from all over the globe to build factories in its special economic zones.

Nor is China’s experience unique; economists have found that FDI, especially in manufacturing, tends to boost growth. In addition to providing capital for new buildings and machines, FDI is a way of transferring technology between countries. When US companies build a factory or other facility in a developing country, they show the locals how advanced machinery, production processes and other technologies work. Those locals can then go start their own companies, making use of what they learned and raising productivity in the domestic economy. In the long run, technology is what makes a country rich, and because learning technologies from developed nations is much cheaper than reinventing them, tech transfers are a good way to help a country develop quickly.

India has long been faulted for lagging behind China when it came to FDI, especially in manufacturing. But things may be changing, as China becomes more insular and India makes an attempt to open up:

The US is already one of the largest direct investors in India (it’s hard to know because most Indian FDI comes in through tax havens). But joint exports to boost bilateral investment would pay o both for India, and for the US investors who reap the returns.

Increasing US-India FDI would yield multiple bene ts. In addition to making both countries money and aligning the interests of the two nations even further, making India a richer, more advanced and more powerful country would strengthen it as a bulwark against Chinese domination of Asia. India is already taking various steps to try to attract more US direct investment; now the US needs to do its part. Tax breaks and other incentives for US companies to invest in India could help grow and solidify this crucial 21st-century partnership.

To view the original blog, click here.