Historically, worldwide innovation has been concentrated. Between 1995 and 2014, the US, Japan, Germany, France, and the UK (henceforth the G5) accounted for about three-quarters of the global stock of innovations – measured by international patent families – and an even larger fraction in the earlier part of the period. They were also responsible for the bulk of R&D spending over those years. This geographic concentration is one reason why the diffusion of knowledge and technology across borders is important to share growth potential across countries.

The innovation landscape is changing

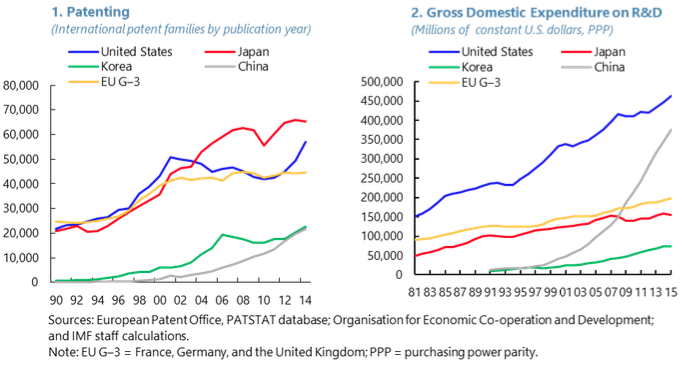

A striking development in recent years has been the rise of South Korea and China as innovators, whether measured by patenting or R&D spending. China’s R&D spending is now second only to that of the US (Figure 1). South Korea and China are today among the top five most innovative countries in a number of sectors, either based on the stock of R&D or the stock of international patents. Their rise has been particularly pronounced in the electrical and optical equipment sector and, for South Korea, also in machinery and equipment.

Figure 1 Patenting and R&D at the frontier

Notably, innovation between economies at the technology frontier (G5) has been diverging from other economies. Since the early 2000s, there has been a pronounced slowdown in the growth of patenting – and to a lesser extent R&D – in the G5. This mirrors the well-documented slowdown in labour productivity and total factor productivity. Growth in innovation and productivity held up better in emerging market economies and, to a lesser extent, in other advanced economies (Figure 2).

Figure 2 Slowdown in patenting and productivity

Diverging dynamics could reflect changes in the way innovation diffuses from the frontier to other regions. The dramatic increases in international trade and capital flows, and the progress in information and communications technologies, have made it easier for countries, especially emerging market economies, to access the international stock of knowledge. Much recent research highlights the importance of trade and foreign direct investment for technology diffusion (e.g. Keller 2004, 2011).

In recent papers (Eugster et al. 2018, IMF 2018), we take a new look at the process of international technology diffusion and its evolution as globalisation has progressed since the mid-1990s. We ask three main questions:

- Have knowledge flows become more globalised?

- What was the role of foreign knowledge flows in boosting domestic innovation and, more generally, productivity, especially in emerging market economies?

- What was the impact of increased international competition – resulting for example from China opening up to global trade – on innovation and cross-border technology diffusion?

To answer these questions, we exploit the rich global patent dataset (PATSTAT), maintained by the European Patent Office, in addition to measures of R&D and productivity. Our methodology builds on the work of Peri (2005) and Coe and others (2009), but extends it by introducing the industry dimension, widening the geographical scope of the analysis to include emerging market economies, and focusing on the most recent decades (1995-2014).

More globalised knowledge flows

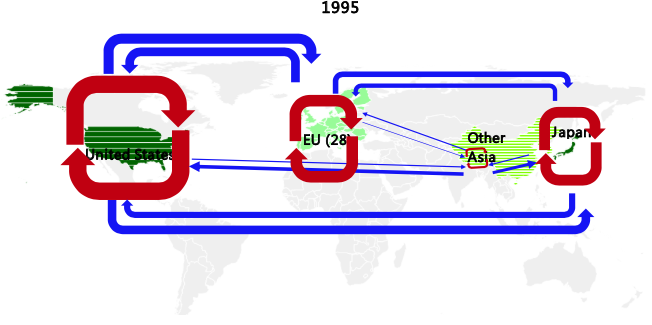

PATSTAT allows us to trace knowledge flows using cross-patent citations, that is, the extent to which countries cite patents from other innovators as prior knowledge in their own patent applications. A first look at the data (Figure 3) suggests knowledge flows have increased significantly over the last two decades, and China and South Korea (depicted in Figure 3 as ‘other Asia’) have become substantially more integrated in global citations, both as citing and as cited innovators.

Figure 3 The evolution of cross-patent citations within, and across, regions between 1995 and 2014

But we need to look beyond raw citation counts. To measure the intensity of knowledge diffusion, we follow Peri (2005) and estimate the predicted frequency at which a given country-sector cites innovations of the technology leaders (taken to be the G5) – relative to the presumed ‘frictionless’ frequency of citation within the technology leader. This is based on a model in which cross-patent citations between country-sector pairs are a time-varying function of geographical distance between the two, technological distance, whether the countries share a common language or have historic colonial ties, and a large number of fixed effects which control for the stock of innovations and institutional changes in the propensities to patent and cite.

Using this measure confirms that the share of technology leaders’ knowledge that diffuses to emerging market economies has increased steadily and significantly over time – and this finding is robust to excluding China from the ‘recipient’ economies (Figure 4). In contrast, the diffusion of knowledge from the G5 to (non-G5) advanced economies has remained flat or even moderated somewhat – albeit from a higher level – since the global financial crisis.1

Figure 4 Estimated intensity of knowledge diffusion

Capitalising on knowledge flows

Next, we ask whether foreign knowledge flows impacted the innovation capacity and productivity of recipient countries. Our findings suggest that they do, and increasingly so. We estimate the impact of knowledge flows from technology leaders (G5) – measured by their R&D stock interacted with the estimated intensity of knowledge diffusion presented above – on patenting, and on labour and total factor productivity of other countries.2

We find that both emerging market and other advanced economies have been able to capitalise on knowledge flows from the G5 to increase domestic innovation (measured by patenting) – with foreign knowledge playing a relatively larger role than domestic R&D in emerging market economies. These results also apply to productivity, suggesting that knowledge from the G5 has contributed to boosting income levels in other countries.

The impact on productivity is economically meaningful, especially for emerging market economies. For instance, between 2004 and 2014, knowledge flows from the technology leaders may have generated, for an average country-sector, about 0.7 percentage point of labour productivity growth per year (Figure 5). This amounts to about 40% of the observed average sectoral productivity growth in this period.

Figure 5 Contribution of foreign knowledge to labour productivity growth in emerging market economies (annual % growth across country sectors)

The impact of foreign knowledge flows on domestic technological progress has increased significantly over time. This is especially true for disembodied measures of technological progress such as innovation and total factor productivity (but not for labour productivity).

Growing competition from emerging market economies

We also examine the effect of growing international competition on foreign knowledge flows.

The degree of product market competition is a key theoretical determinant of innovation activity. Its intensity has changed over time, shaped in part by the reduction in trade barriers with globalisation. We construct two measures of international competitive pressures that are reasonably exogenous to developments in specific country-sectors:

- The evolution of import penetration from China in US industries. We use this measure to instrument import penetration in ‘recipient’ advanced economies.

- Indices of industry concentration at the global level. These exclude China from our sample because, as the largest non-G5 country, it could introduce significant reverse causality between domestic innovation and our global concentration measure. We find that, consistently across both measures, greater international competitive pressure has increased both the level of sectoral innovation and its sensitivity to foreign knowledge flows.

Although, theoretically, competition has ambiguous effects on innovation, our results point to a positive empirical relation internationally. A small but growing number of papers has tried to empirically address this question. Autor et al. (2016) find that increasing competition from China has lowered innovation in US industries, while Bloom et al. (2016) find the opposite for European firms. Our results capture the conclusions of Bloom et al. (2016), as many European countries are included in our sample of countries. However, they cannot be directly compared to Autor et al. (2016), because we consider the US only as a source of knowledge flows, and not as a sample country.

Conclusions

Globalisation has intensified the international diffusion of technology, which is crucial to share growth potential across countries and boost global growth. The positive impact has been particularly large for emerging market economies, helping increase productivity for them, and supporting income convergence. Our results also suggest that the growing competition from emerging market economies may lead to more innovation, even in advanced economies.

Authors’ note: This column is dedicated to the memory of our friend and colleague Giang Ho. Her wit, smile, and dedication are sorely missed. The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.

References

Autor, D, D Dorn, G H Hanson, G Pisano, and P Shu (2016), “Foreign Competition and Domestic Innovation: Evidence from US Patents”, NBER working paper 22879.

Bloom, N, M Draca, and J Van Reenen (2016), “Trade Induced Technical Change? The Impact of Chinese Imports on Innovation, IT and Productivity”, Review of Economic Studies 83(1): 87–117.

Coe, D T, E Helpman, and A W Hoffmais¬ter (2009), “International R&D Spillovers and Institutions”, European Economic Review 53 (7): 723–41.

Eugster, J, G Ho, F Jaumotte, and R Piazza (2018), “International Knowledge Spillovers“, IMF working paper 18/269.

International Monetary Fund (2018), “Is Productivity Growth Shared in a Globalized Economy?”World Economic Outlook: Chapter 4.

Keller, W (2004), “International Technology Diffusion”, Journal of Economic Literature 42: 752–82.

Keller, W (2010), “International Trade, Foreign Direct Investment, and Technology Spillovers”, in B H Hall, N Rosenberg (eds.), Handbook of the Economics of Innovation Volume 2, Elsevier: 793–829.

Peri, G, 2005, “Determinants of Knowledge Flows and Their Effect on Innovation”, Review of Economics and Statistics 87 (2): 308–22.

Endnotes

[1] This is consistent with the slowdown in trade which has affected advanced economies after the global financial crisis, although we did not test formally for this hypothesis.

[2] The results are obtained controlling for own domestic R&D stock and a number of country-time fixed effects to control for institutional changes.

[To read the original column, click here.]

Copyright © 2019 VoxEU. All rights reserved.